Our Approach

Baobab client who runs a fruit stall / Baobab

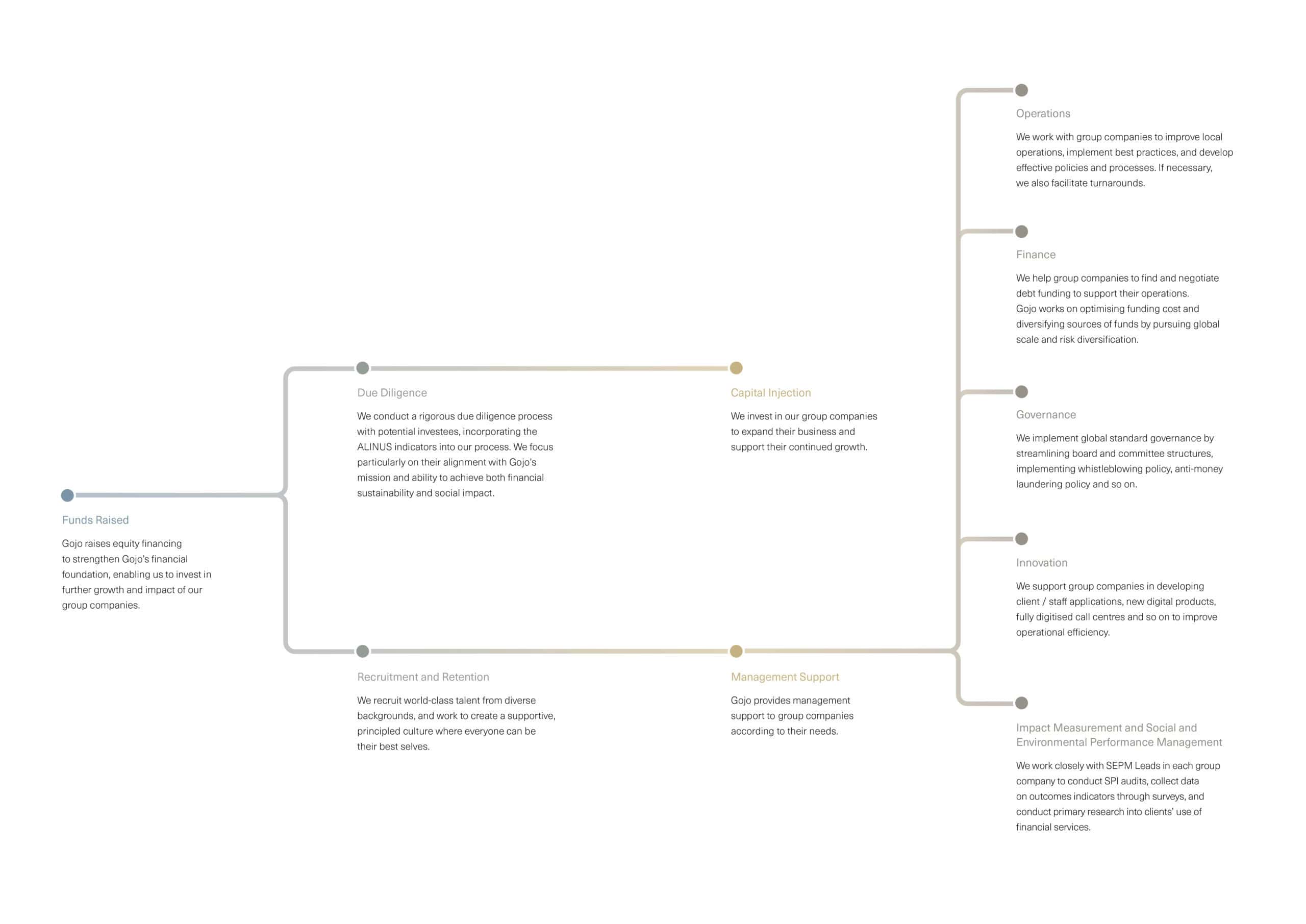

Our Business Model

Gojo enables financial inclusion by helping financial service providers succeed.

As a holding company, a key focus of Gojo is raising funds from investors aligned with our mission and channelling those funds into group companies and investees to expand their reach and impact.

Our Products

A centre meeting in India / Taejun Shin

Gojo Group and its major investees address financial exclusion by offering a suite of microfinance services.

Joint Liability Group (JLG) Loans

A JLG is made up of three to ten neighbours who come together to secure loans. They are ideal for low-income households who cannot provide collateral and have limited credit records. Group members select each other and guarantee each other's repayments. This keeps default rates low and ensures that borrowers are of good standing in the community.

Individual Loans

Individual loans (or personal loans) are purpose-based loans that could be used for a variety of personal expenses. Some are general consumption loans to mitigate income volatility risks, whereas others are targeted loans with a purpose from home renovations, medical expenses, education expenses, to funeral costs. These loans can also be used for business purposes, such as starting or expanding a small enterprise. This type of loan can cover any goal of individuals without requiring them to be a part of a credit group.

Micro, Small, and Medium Enterprise (MSME) Loans

Access to capital is one of the biggest hurdles MSMEs face, as they're less likely to acquire bank loans. Microfinance institutions’ MSME loans serve as an accessible alternative by offering small businesses flexible loan options. These loans help businesses with working capital expenses, long-term capex, and business expansion.

Microsavings

Microsavings are small deposit accounts offered to low-income households or individuals as a means of storing funds for future use. They are typically categorised as voluntary or compulsory and as term or non-term. Voluntary savings are flexible accounts that clients can use at their discretion, while compulsory savings are typically linked to loan requirements. Term deposits have a fixed duration and help clients meet long-term goals, whereas non-term deposits offer more immediate access to funds.

Microremittances

Remittances are a vital source of income for many households, especially in regions where family members work abroad or in distant cities. Remittance services help send these funds quickly and safely, making sure they reach the recipient without delay.

Microinsurance

Microinsurance for low-income households enhances resiliency in the face of financial crises. It is designed to be affordable and cover unexpected risks such as illness, accidents, or natural disasters.

Digital Banking

As internet penetration rates and the number of mobile phone users increase, digital banking products make financial services more flexible and accessible. Through mobile phones, clients can execute payments, transfer money, complete purchases, and many more.

From Microcredit to Microfinance

Boat driver in Ayeyarwady Region. The region is full of rivers so people use boats like buses. / Taejun Shin

The income of low-income people in developing countries is not only small but also unstable. The latter part is often underestimated, but for those living in poverty, it is a fatal challenge. As in the other parts of the world, most people want to work for a place that provides them with stable and reliable income. While there are entrepreneurial households which are typical clients of microcredit, the majority are non-entrepreneurial – in fact, they are reluctantly self-employed because of the lack of job options.

Entrepreneurs mostly benefit from financial services to invest in their businesses, while non-entrepreneurial households mostly benefit from money management services to allow them to deal with the combination of unstable income and unexpected life expenses. Conventional microcredit is the best tool for the former needs. For money management services, a combination of flexible deposit and borrowing is the solution. Given its rigid payment schedule, conventional microcredit is rarely the best tool for money management services and therefore for most low-income people.

Due to cost and regulatory reasons, most microfinance institutions (MFIs) focus on microcredit – flexible services tend to make operations costly, and obtaining a deposit-taking license is not easy, especially for small MFIs or in certain countries such as India.

As a result, while microcredit generates an impact on the entrepreneurial low-income households, the non-entrepreneurials may be using it as a money management tool along with other informal financial instruments, such as loans from private money lenders, savings groups, etc. Some studies suggest that (1) microcredit, if provided to the general public among low-income households, does not create a positive impact on income growth or consumption smoothing, but (2) microcredit helped low-income business owners (who used to run businesses before obtaining the loan) double their income in six years on average. The study results coincide with our understanding of reality.

To truly extend financial inclusion (= access to useful and affordable financial services) to everyone, Gojo needs to scale the business to obtain a deposit-taking license. Economies of scale also allow for the absorption of the costs of flexible financial services for non-entrepreneurial low-income households. In some countries, we are able to do this as a leading microfinance player in the nation, and our strategy is to do this everywhere we operate in the future.

Source:

- Abhijit Banerjee, Emily Breza, Esther Duflo & Cynthia Kinnan, ”Can Microfinance Unlock a Poverty Trap for Some Entrepreneurs?”, NBER Working Paper (2019)

- Abhijit Banerjee, Esther Duflo, Rachel Glennerster and Cynthia Kinnan, ”The Miracle of Microfinance? Evidence from a Randomized Evaluation”, American Economic Journal: Applied Economics (2015)

- Daryl Collins, Jonathan Morduch, Stuart Rutherford & Orlanda Ruthven, ”Portfolios of the Poor: How the World's Poor Live on $2 a Day”, Princeton University Press (2009)

- Stuart Rutherford, ”The Poor and Their Money”, Oxford University Press (2001)

Sign up to receive news from Gojo here.