Our Impact in Numbers

Our Impact in Numbers

Our Impact in Numbers

A Cambodian lady who now runs a weaving factory with several employees / Taejun Shin

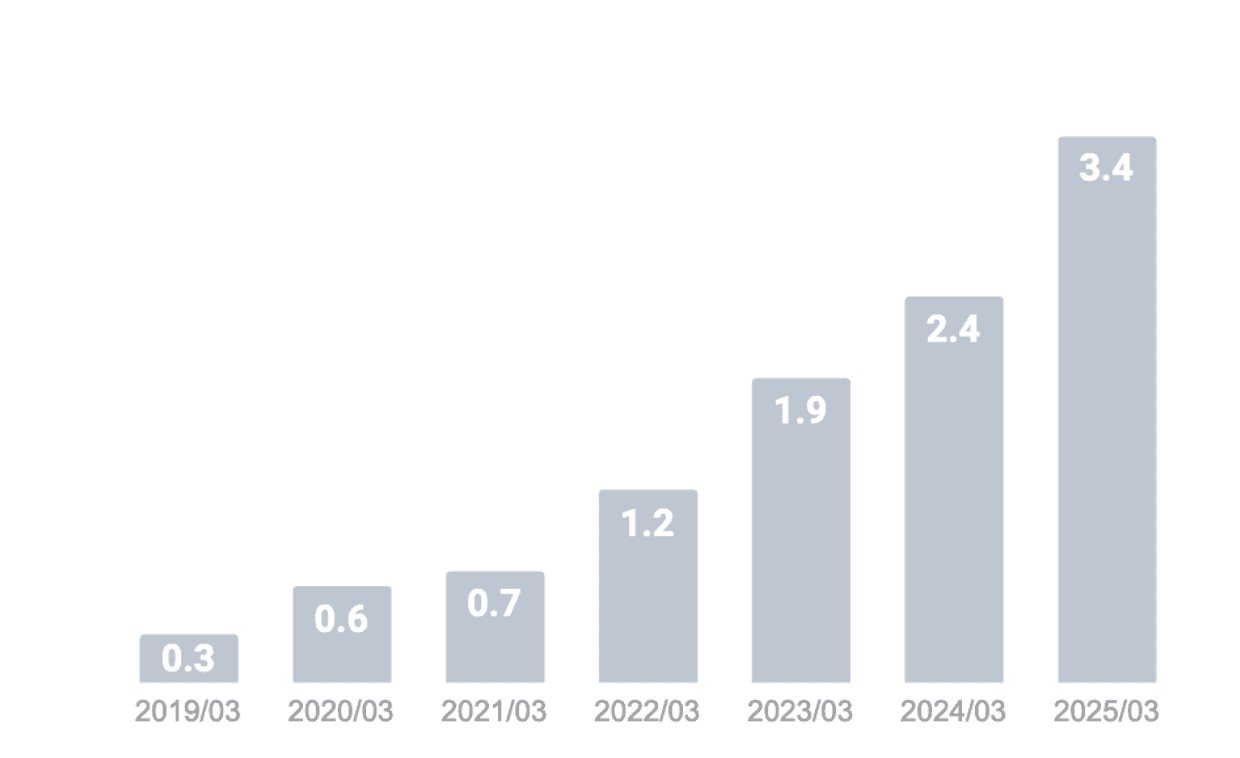

As of March 2025, Gojo Group and its major investees have reached more than

3.4 million clients

Aggregated unique clients of Gojo Group (subsidiaries and equity method affiliates) and its major investees, excluding Ananya wholesale, Loan Frame, Aviom, MyShubhLife, and UNLEASH (in millions).

Client numbers are not unique across different companies.

73%

of our clients are women.

67%

of our clients live in rural areas.

Sign up to receive news from Gojo here.