Gojo & Company, Inc. (“Gojo”) is pleased to introduce a Social Finance Framework (“Framework") as a guiding structure for its fundraising activities aimed at creating positive social impact.

The Framework has been designed in alignment with the Social Bond Principles (SBP) 2023 issued by the International Capital Market Association (ICMA), as well as the Social Loan Principles (SLP) 2023 issued by the Loan Market Association (LMA), the Loan Syndications and Trading Association (LSTA), and the Asia Pacific Loan Market Association (APLMA). It adheres to the four core components common to both sets of principles: (1) Use of Proceeds, (2) Process for Project Evaluation and Selection, (3) Management of Proceeds, and (4) Reporting. Development of such a Framework is the first ever initiative in Japan. The Framework is unique in a sense that it adheres to globally recognised standards, as well as accommodating equity financing, alongside debt.

In establishing this Framework, Gojo has obtained an external review from ISS Corporate Solutions, Inc. (“ISS”), an independent external reviewer. The project was supported by Nomura Securities Co., Ltd., acting as the structuring advisor.

Background and Purpose of the Framework

The Framework was developed to ensure transparency and clarify the link between Gojo’s fundraising activities and the social impact we aim to achieve through inclusive financial services. It applies to a broad range of financial instruments, including both private and public bonds, loans, and equity financing—domestically and internationally—enabling social financing through various means.

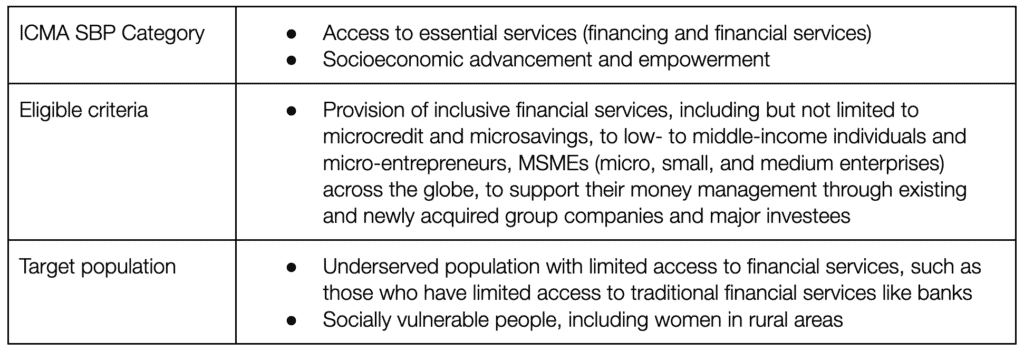

Use of Proceeds and Eligible Projects

The proceeds raised under this Framework will be allocated to “Eligible Social Projects” that align with Gojo’s mission to promote financial inclusion through socially-driven financial service providers.

External Review

To ensure the credibility and transparency of this Framework, Gojo has obtained an external review from ISS, a leading global provider of ESG ratings, sustainability disclosures, and proxy advisory services for institutional investors and corporations. ISS has confirmed that this Framework is aligned with the four core components of both the Social Bond Principles and Social Loan Principles, and that it demonstrates a high degree of alignment with Gojo’s mission.

Gojo remains committed to accelerating the creation of social value through financial inclusion, in pursuit of our vision: “to create a world where everyone can determine their future.”

▼ Gojo Social Finance Framework

(JP) https://gojo.co/wp-content/uploads/2025/07/Gojo_Social-Finance-Framework_Japanese.pdf

(EN) https://gojo.co/wp-content/uploads/2025/07/Gojo_Social-Finance-Framework_English.pdf

▼ Review from ISS

(JP) https://gojo.co/wp-content/uploads/2025/07/Gojo_Bespoke-Social_UoP_Japanese.pdf

(EN) https://gojo.co/wp-content/uploads/2025/07/Gojo_Bespoke-Social_UoP_English.pdf

About ISS Corporate Solutions

ISS-Corporate is a leading provider of robust SaaS and expert advisory services to companies, globally. ISS-Corporate’s data-driven, research-backed Compass platform empowers businesses to understand and shape the signals they send to institutional investors, regulators, lenders, and other key stakeholders. By delivering essential data, tools, and advisory services, ISS-Corporate can help businesses around the world to be more resilient, align with market demands, and proactively manage governance, compensation, sustainability, and cyber risk initiatives.

About Gojo & Company

Gojo is a Tokyo-based holding company of inclusive financial service providers operating in 14 countries in South & Southeast Asia, Central Asia & the Caucasus, and Africa. Gojo was founded in 2014 to extend financial inclusion across the globe. Gojo Group, including major investees, is serving 3.4 million clients across the globe as of March 2025. Gojo has been a Certified B Corporation™ since January 2025, committed to the continuous improvement of its social and environmental performance.