Gojo & Company, Inc. (“Gojo”) is pleased to announce that Gojo has successfully agreed on the USD 9 Mn loan agreement with Credit Saison Co., Ltd. (“Credit Saison”)

Gojo & Company, through its seven group companies based in Cambodia, Myanmar, Sri Lanka and India, operates financial businesses that contribute to financial inclusion, one of the top global issues. Gojo will finance the raised funds to the group companies as inter-company loans.

Purpose of the Loan

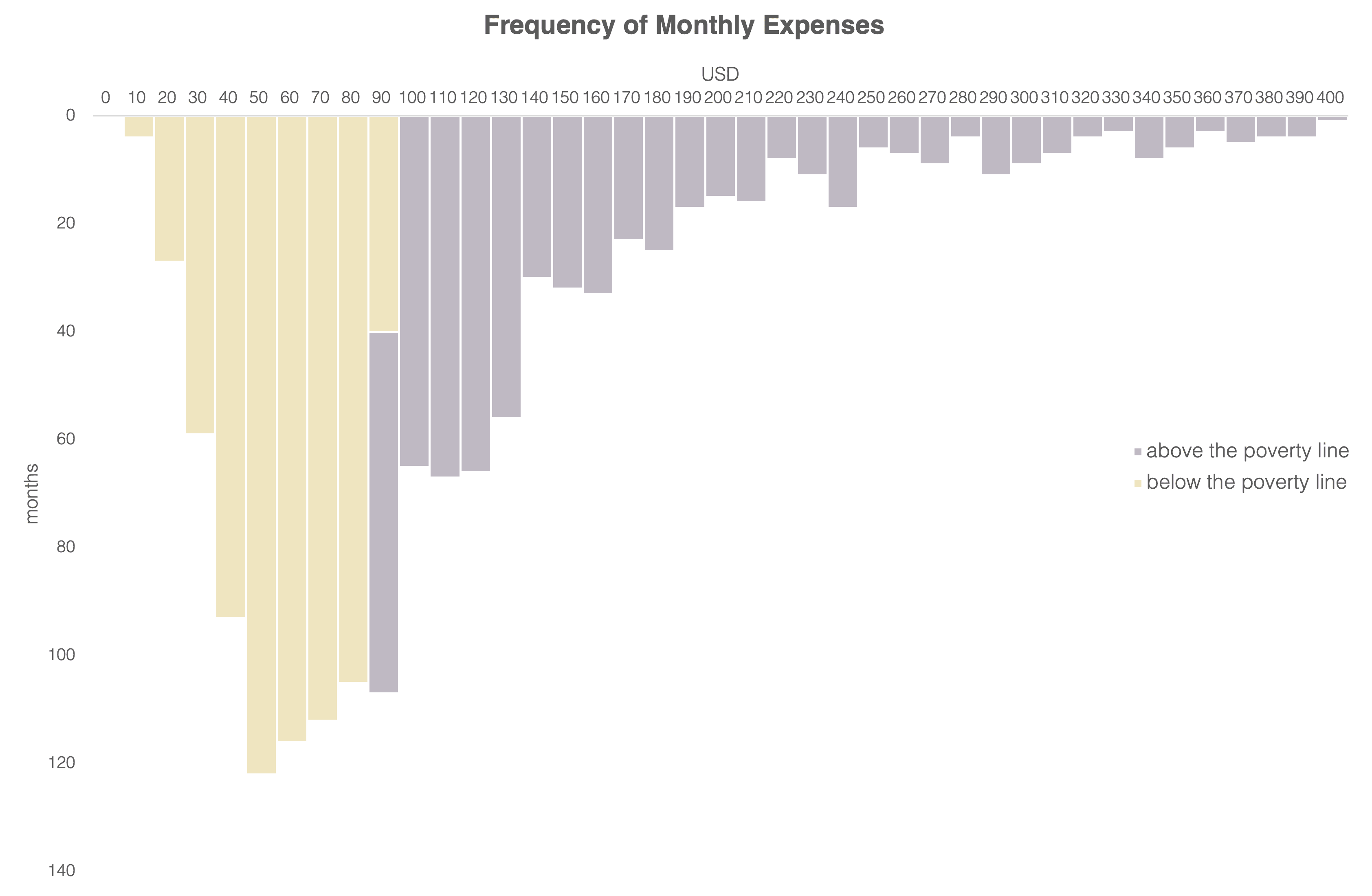

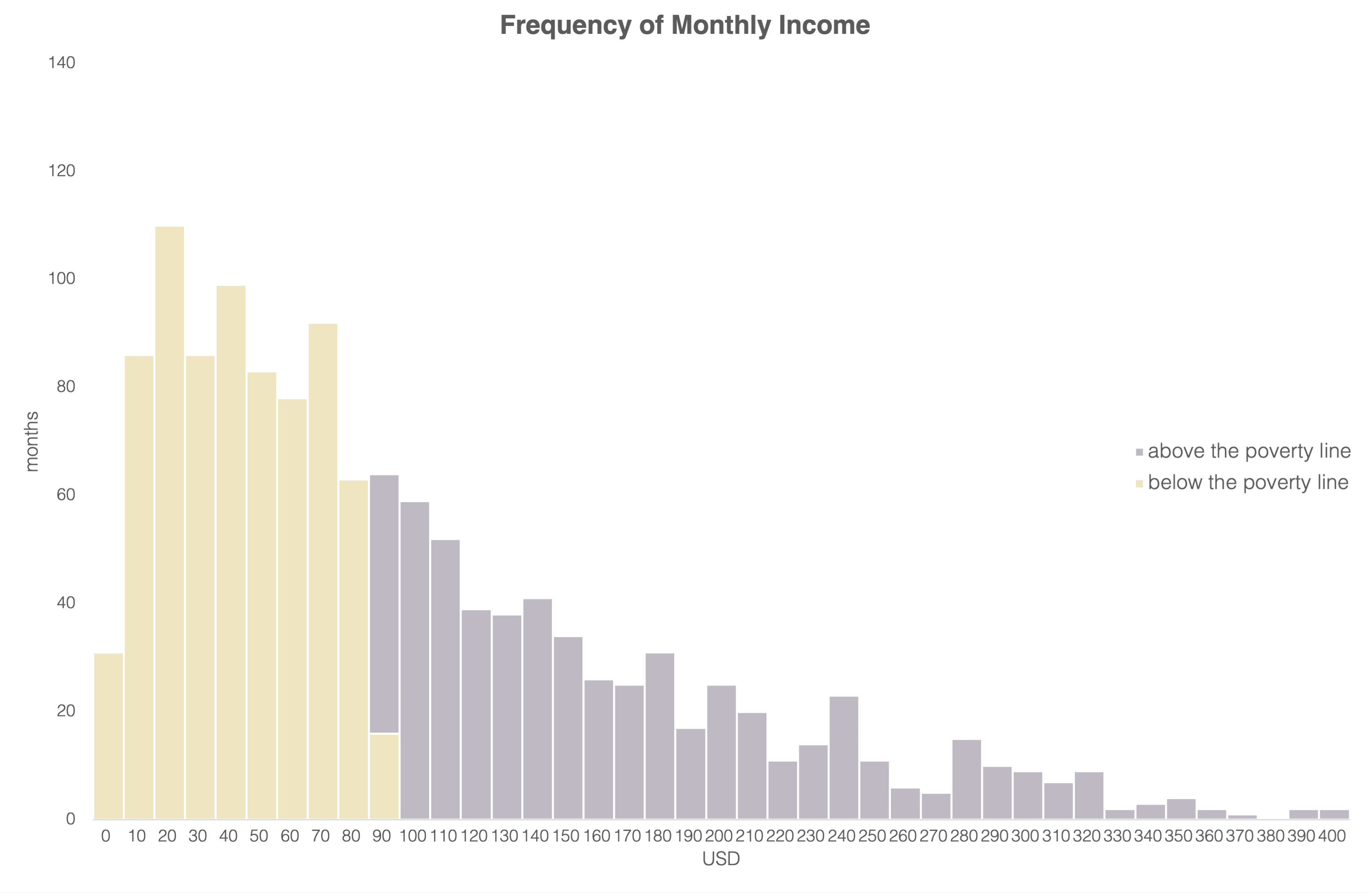

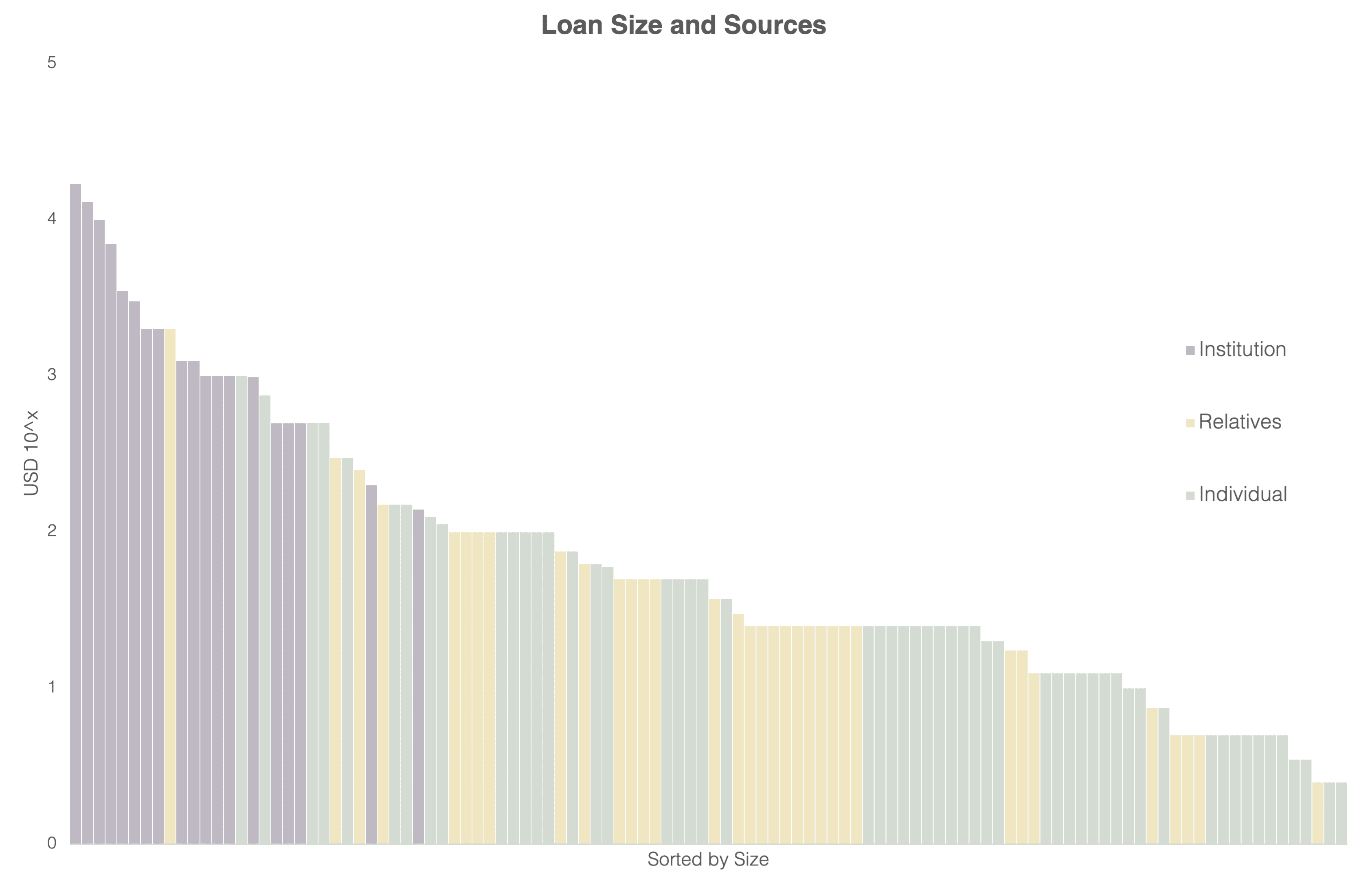

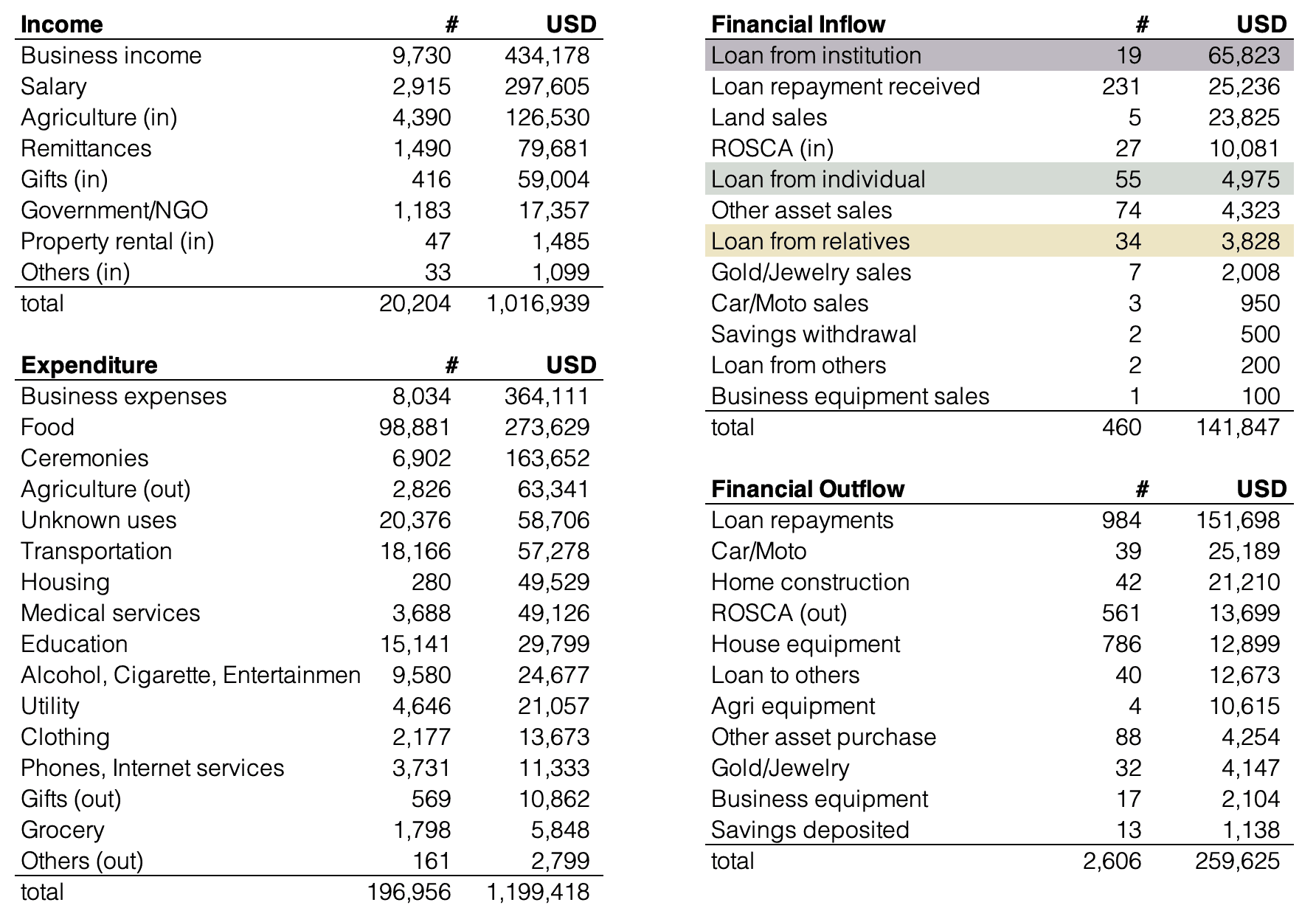

The Group companies that will receive the inter-company loans will use the funds for micro-loans to micro, small and medium enterprises. More than 95% of the borrowers are women entrepreneurs who mainly use the loans for working capital or capital investment in their micro, small, and medium businesses.

Lenders for Microfinance Institutions in Emerging Markets

Microfinance institutions are some of the major borrowers from commercial banks in emerging markets. Other notable lenders are impact investment funds and non-profit organizations based in Europe and other developed countries, who provide loans to microfinance institutions to achieve economic and social impact. On the other hand, most Japanese financial institutions have not yet entered this sector due to concerns on its information gap.

Gojo’s role for Japanese Financial Institutions

Gojo will play the role of a bridge between Japanese financial institutions and microfinance institutions in emerging countries, enabling Japanese financial institutions to reduce screening and monitoring costs.

Gojo is well aware of the market environment in each country, and has a system in place to provide additional value to lenders not only in the form of financial return, but also of market information. With Credit Saison, Gojo will explore not only loan agreements but also the possibility of business collaboration.

Expanding the Network of Japanese Lenders

Five and a half years have passed since Gojo’s inception. Group companies have continued their stable growth while recording profits for several years. Gojo aims to expand the borrowers’ networks by leveraging growth funds from Japanese financial institutions as well as more than 50 lenders from various countries. Gojo will continue to grow its number of borrowers to achieve the long-term goal of delivering affordable and high-quality financial services to more than 100 million people in 50 countries by 2030.

About us

Gojo was founded to extend financial inclusion to everyone in the world beginning with the developing countries. Gojo encourages the formalization and growth of micro, small, and medium-sized enterprises. Our long-term goal is to enable the provision of high-quality affordable financial services for 100+ million unserved and underserved people in 50+ countries by 2030. 5 years since our establishment, we work in Cambodia, Myanmar, Sri Lanka and India with 3,000+ employees, serving more than 500,000 women who are also mothers. The total loan portfolio reached approximately $300 million including off-balanced receivables, and since 2017 the company has made a profit on a consolidated basis.