Introduction

In the village of Hrishipara, Bangladesh, lives 76-year-old Sultana (name changed). To a general observer, she appears to be an elderly grandmother living on a rural homestead. But to the Hrishipara Daily Diaries Project (HDDP) team, she is a woman who effectively used credit, micro-savings, and prudence to build a life of self-sufficiency.

Sultana has been a diarist with the HDDP since 2015. Her journey was never easy. She was educated up to class 8 and married a relative. Her husband deserted her early in the marriage, leaving her to raise three children alone. In rural low-income households, this is a sure ingredient for long-term poverty. However, Sultana possessed a relentless work ethic. Refusing to succumb to despair, she raised her children by husking paddy and rearing livestock, saving every ‘Taka’ she could earn.

Strategic Debt

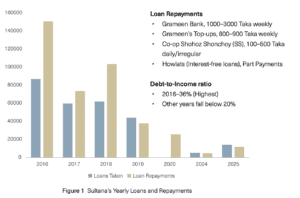

In 1986, she made a decision that would change the financial path of her life: she started taking loans from the Grameen Bank. Over the next four decades, she didn't just borrow; she used Grameen’s suite of products. She took multiple loans and top-ups; her early loans were for capital investments, such as purchasing livestock and housing loans for land acquisition and house construction. Figure 1 below presents a consolidated view of her annual debt cycle and repayments, highlighting her remarkable ability to pay off loans.

As observed in Figure 1, Sultana demonstrates exceptional debt clearance. The data shows high repayment volumes and consistent debt closure, with repayments often structured on a weekly and monthly basis. Notably, towards the end of 2025, she is primarily debt-free.

She used borrowing to generate income and build assets, and eventually leveraged credit to finance her sons' overseas migration, a calculated investment that would pay dividends later.

Aggressive Savings

While many see loans as the primary tool for growth, Sultana not only utilised loans but also understood that savings are the actual engine of wealth. She became a disciplined contributor to Grameen Bank’s savings products, such as the Grameen Pension Savings (GPS) and Fixed Deposit scheme, which doubled every seven years in the early years. In addition, she saved in Shohoz Shonchoy* (Easy Savings, co-operative), a daily savings model for low-income households led by Stuart Rutherford (Director of HDDP).

In earlier years, her deposits were modest: 1,000 Taka per month for GPS, 150–200 Taka in Grameen’s general savings account, and 20–40 Taka daily in Easy Savings. However, her consistency was key. When her sons began sending remittances from abroad, she diligently repaid her loans and fully saved the remaining funds. When her savings matured after 10 years at GPS, she reinvested them in Grameen’s fixed deposit schemes, which doubled in value over time. She treated every Taka held as a brick in the foundation of her future.

Dream House

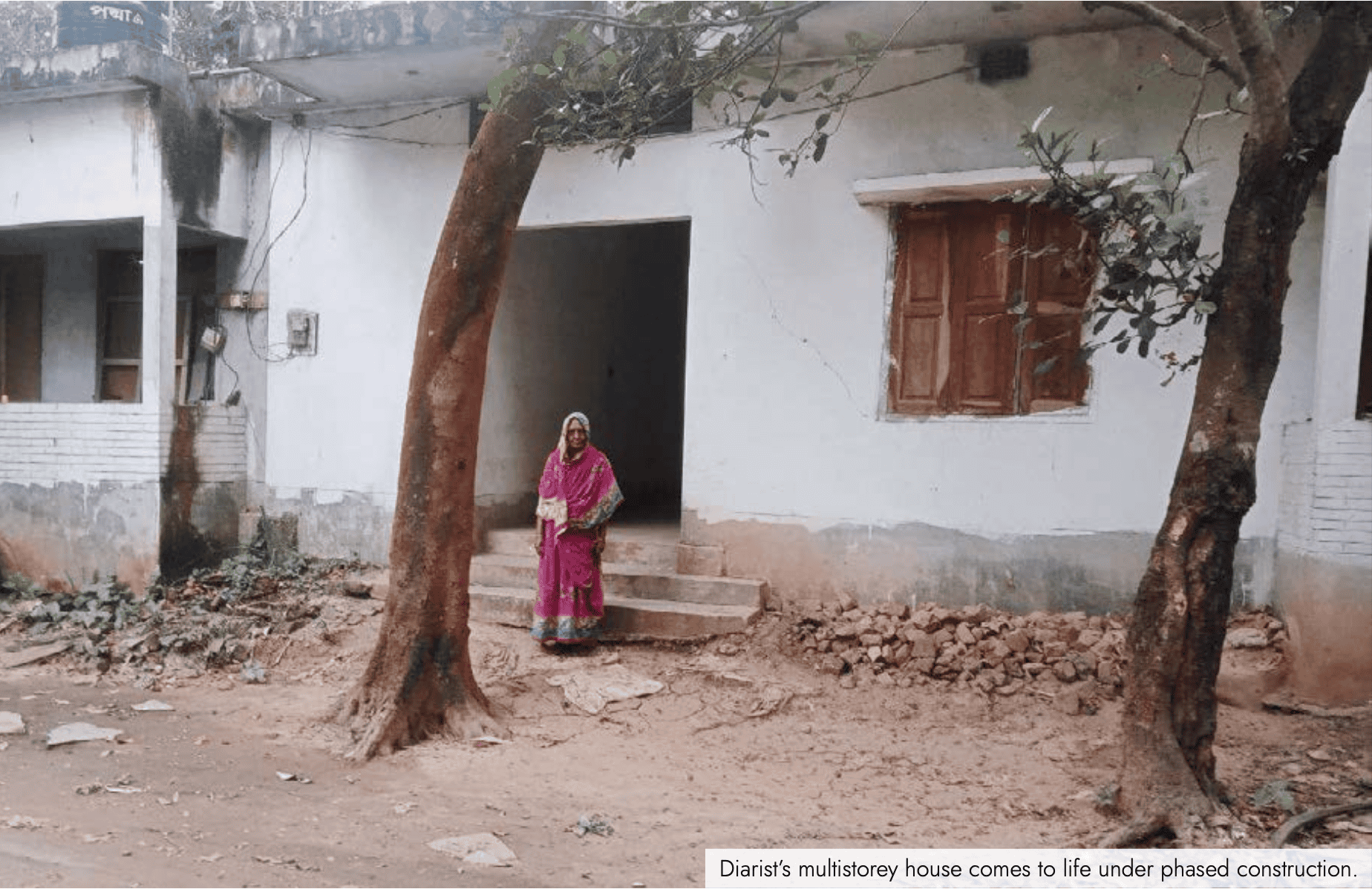

Sultana’s most significant "investments" were in her children. Using her savings and loans, she sent both sons, and later her grandson, overseas for work. For 12 years, her eldest son sent remittances via Agrani Bank, while her younger son used bKash, Bangladesh’s leading Mobile Financial Services (MFS) company. Sultana managed these funds with precision. She cleared her loans, maintained her savings, and in 2018, began her ultimate project: replacing her mud house with a concrete home.

Sultana shared the pictures of her house plan during our visit. Her vision was a three-storey building where her entire family, with children and grandchildren, could live together. Remarkably, she spent 1,700,000 Taka just to lay the foundations, primarily from her savings. She has built multiple rooms and finished one storey of her house as of 2025.

Conclusion

Today, at 76, Sultana is far from "retired." She now works as a babysitter and diligently continues to save her earnings. When we asked the simple question, "Why do you still save?" her response was poignant: "I want to put away for the future... I don't want to be a burden if I fall ill."

Sultana lives alone as her sons work outside Hrishipara. She understands that as their families grow, resources will stretch. Yet, she looks forward, currently helping her son process a visa for overseas travel and dreaming of the day her three-storey home is finally complete. She even occasionally supports her estranged husband’s medical needs.

Among other diarists, Sultana stands out as a resilient figure in the project. She grew her earnings into a formidable sum by taking on strategic debt to build assets and by maintaining reinvestment habits. Through micro-savings and the use of suitable financial products, she changed a position of vulnerability into independence.

*Shohoz Shonchoy (Easy Savings) started in 2002, is an ultra-flexible microfinance organisation for poor and very poor people, focusing on savings but also offering loans with no fixed repayment schedule, no fixed repayment period, and no requirement to join a group. It aims to serve rather than make a profit, but has generated a surplus over time.

Written by Mercyline Manoj