Gojo is pleased to announce the publication of the Impact Report (2024 August) .

Gojo’s mission is to extend financial inclusion across the globe. Through our nine group companies* in five countries — Cambodia, Sri Lanka, Myanmar, India and Tajikistan — Gojo Group encompasses 2.4 million clients as of March 2024. 96% of our clients are women, and four out of five clients live in rural areas.

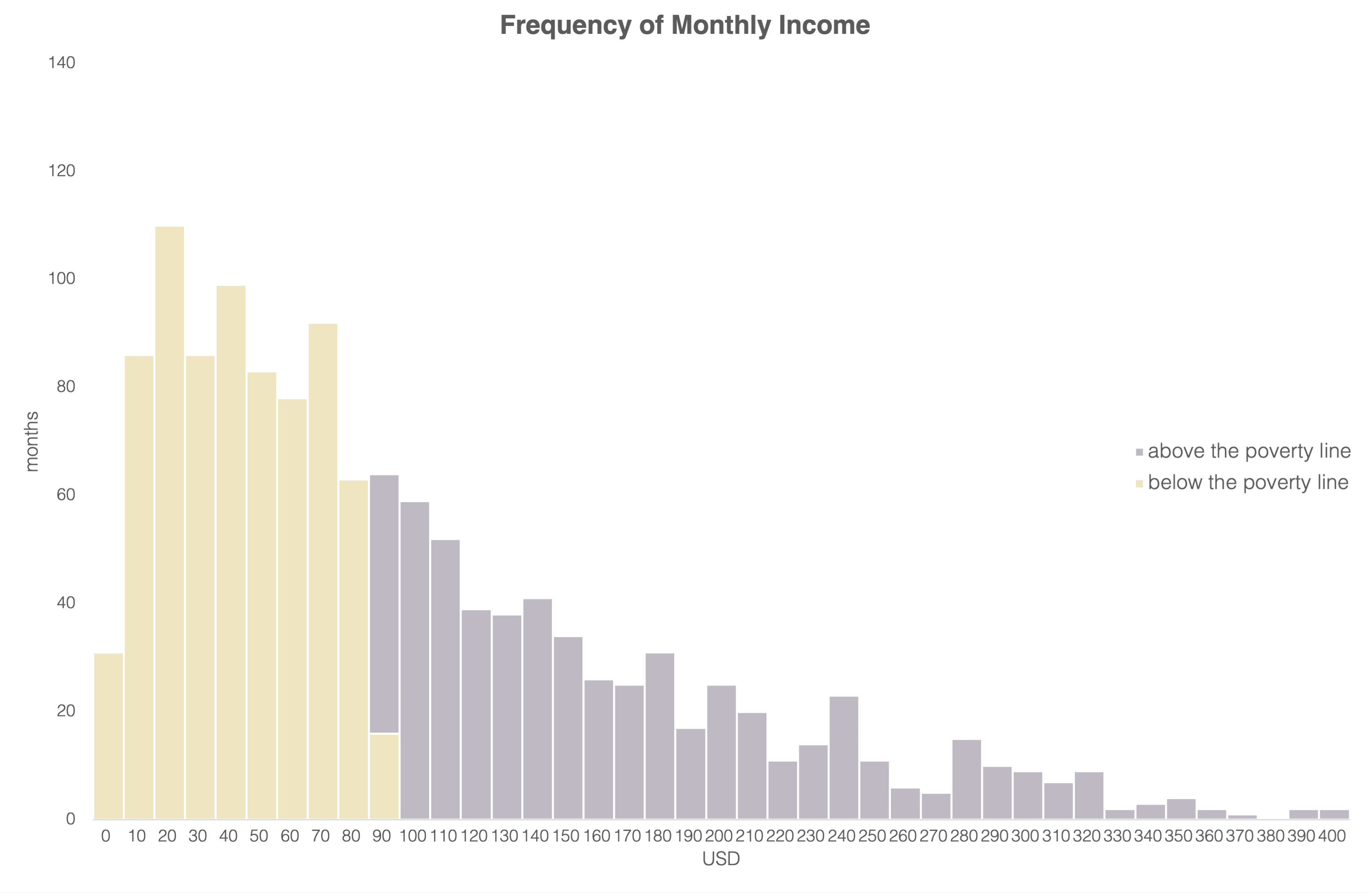

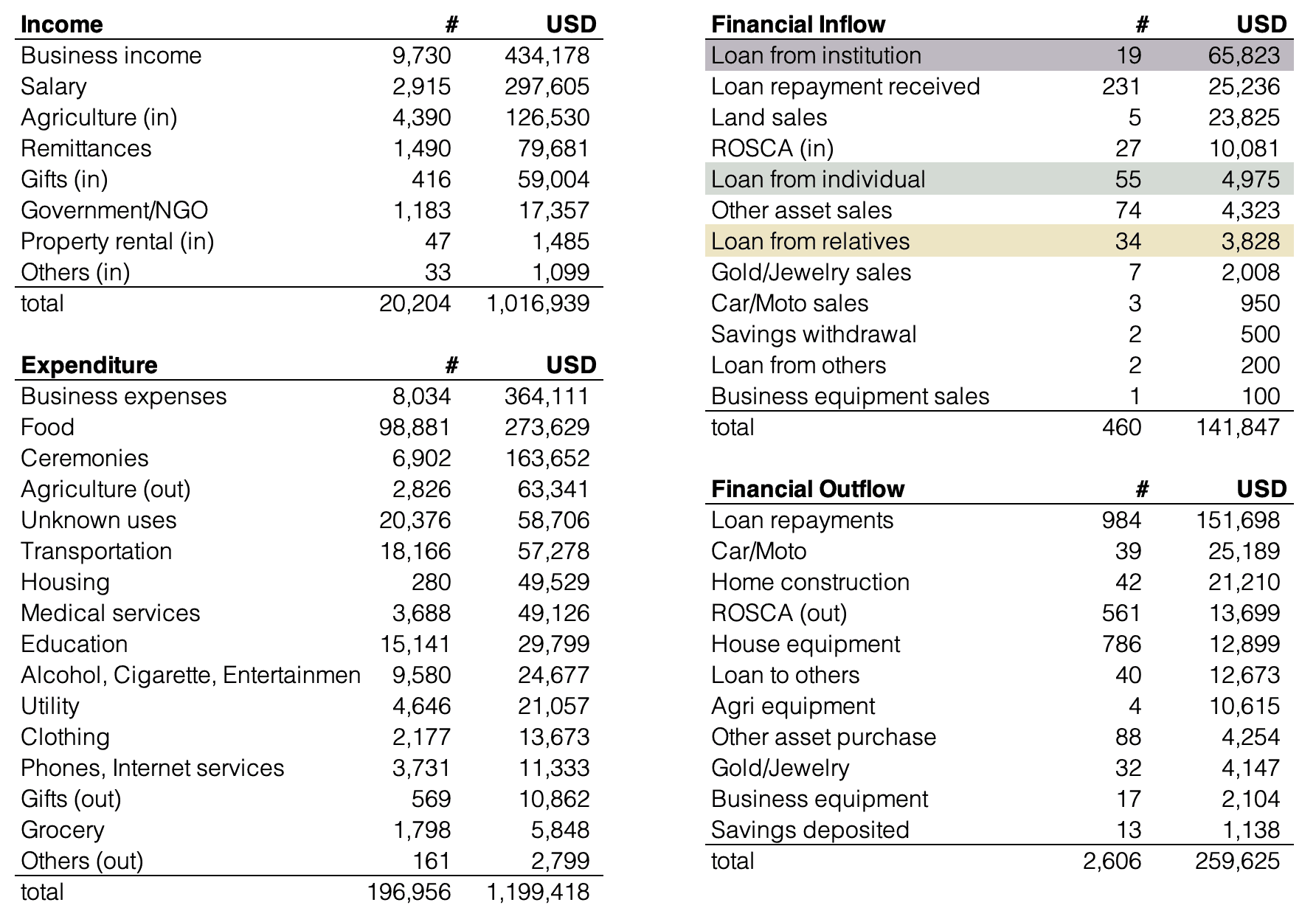

In this Impact Report, we take a step back to think again about what financial inclusion really is. Gojo defines financial inclusion as “having access to useful and affordable financial services”. According to the Global Findex Database 2021, access to financial services has improved significantly, with the percentage of people aged 15 and above in developing countries who have an account with a financial institution increasing from 42% in 2011 to 71% in 2021. Therefore, the quality and affordability of financial services are becoming increasingly important. The impact of financial inclusion is another discussion point - while financial inclusion has called out for poverty alleviation over many years, the reality is that microfinance does not always lead to income increase. We acknowledge this and strive to improve our outreach and quality of the services so that we provide more choices for clients in better money management, and as a result, empower them to determine their own future.

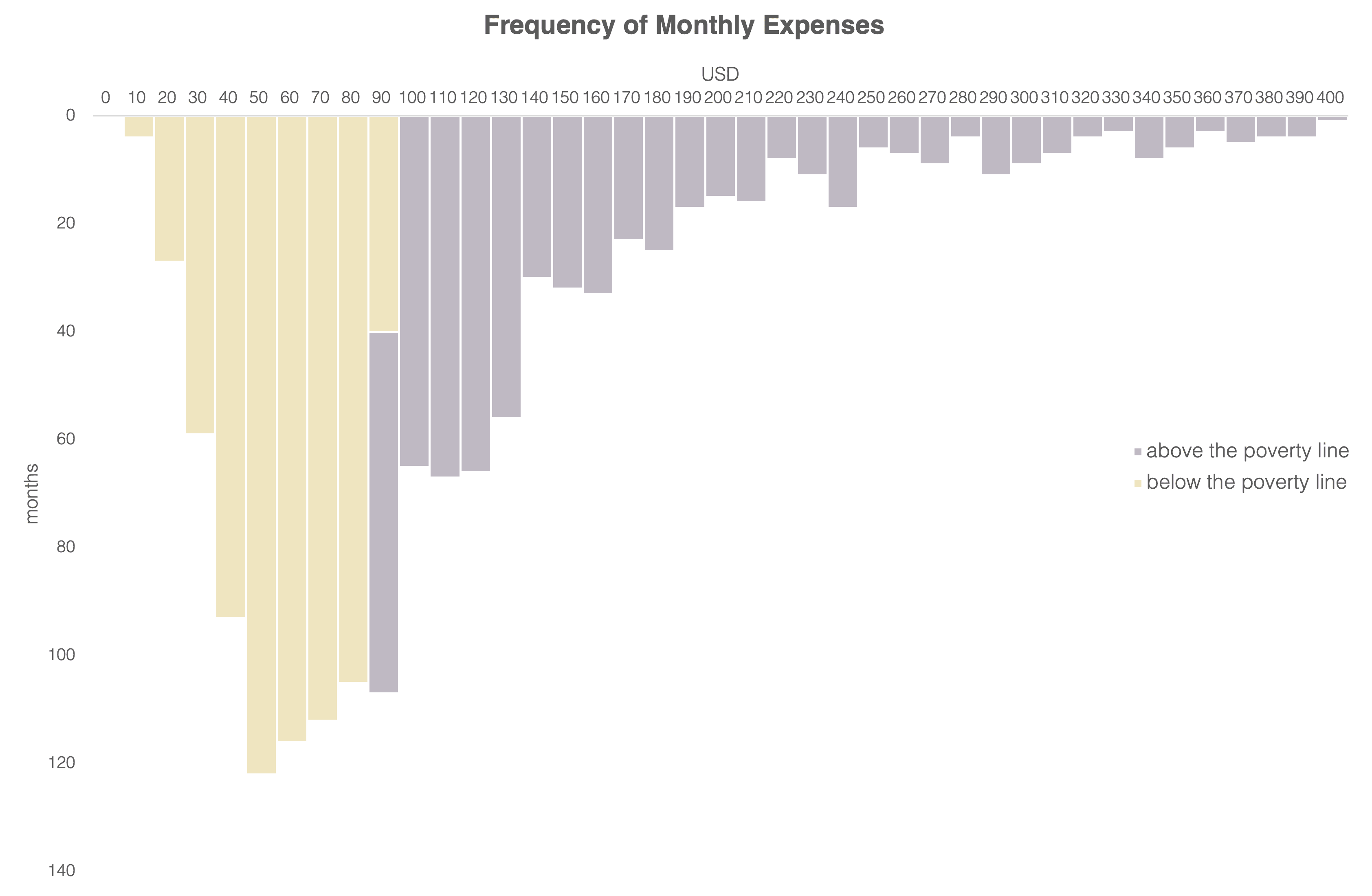

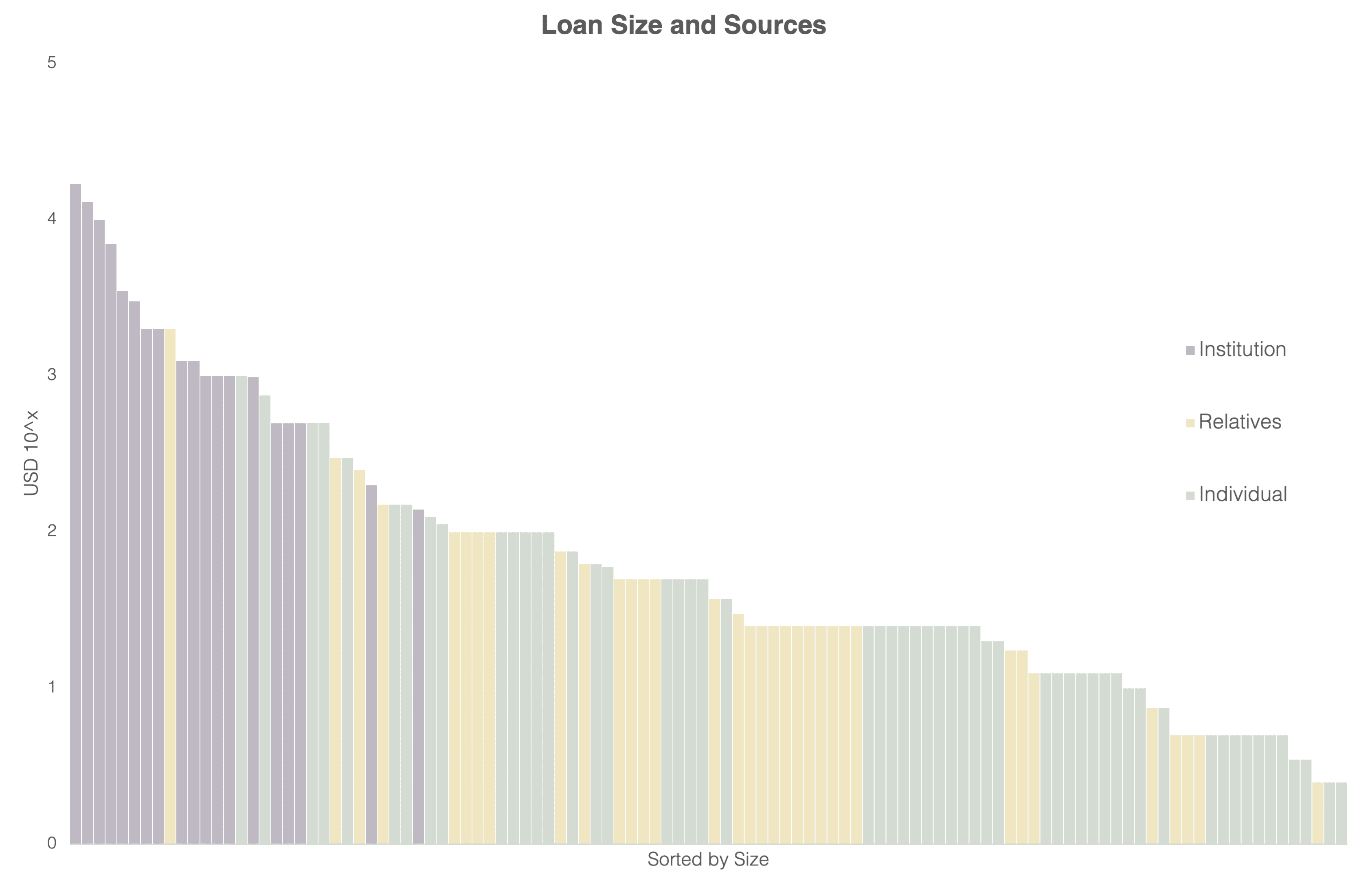

We also shed light on the side effects of microfinance. Over-indebtedness is a situation in which a client's debts have exceeded his or her ability to repay them. The causes of over-indebtedness are complex. Clients’ income tends to fluctuate due to its informal nature and it is hard to predict over the term of the loan. It can easily be affected by unexpected incidents such as natural disasters, economic crises, pandemics, and so on. Clients sometimes need to make unwanted sacrifices when it becomes difficult for them to repay the loan. Gojo Group aims to prevent over-indebtedness through improvement of loan assessment processes and continuous monitoring, and ensure that collection practices adhere to the Client Protection Standards.

In this context, Social Performance Management (SPM) is evermore important. SPM is a framework defining responsible operations of financial service providers, ensuring no harm to clients and other key stakeholders. Following the Universal Standards of Social and Environmental Performances (USSEPM), Gojo conducts SPI audits to assess the level of SPM practices at group companies and take action to improve them. We conducted SPI audits for MIFIDA and Humo and shared the results in this report. Four out of six consolidated companies have obtained Client Protection Certifications.

Finally, there is also progress made in other areas of operation. Gojo established UNLEASH Capital Partners, a venture capital business, targeting fintech startups in India to explore financial inclusion outside of microfinance. We launched a new initiative in digital financial inclusion called the “Pasio program” which offers digital loans paired with business skill training and online e-commerce and community platform. The female ratio of Gojo members improved to 44%, and we are continuously improving our measurement of GHG emissions to have a better understanding of our environmental impact. You may also notice that throughout the report, we have included client stories which are not always success stories, with the intention of conveying the reality in the field as best we can.

We hope you enjoy reading our Impact Report.

Impact Report Webinar

Please join us for an upcoming webinar this September, in which we will share the key findings from our Impact Report. We will hold two webinars, each in Japanese and English.

[Webinar in English]

Date: Thursday, September 19, 2024

Time: 11.00-12.00 CET / 18.00-19.00 JST

Registration form: Link (prior registration is required)

[Webinar in Japanese]

Date: Tuesday, September 17, 2024

Time: 19.00-20.00 JST

Registration form: Link (prior registration is required)

We look forward to your participation.

About us

Gojo & Company, Inc. is a Tokyo-based holding company of nine inclusive financial service providers* operating in Cambodia, Myanmar, Sri Lanka, India, and Tajikistan. Gojo was founded to extend financial inclusion across the globe, beginning with developing countries. Our goal is to enable the provision of high-quality affordable financial services in 50 countries. Established in 2014, Gojo Group is serving more than 2.4 million clients across the globe as of March 2024.

*For the Impact Report, group companies include nine financial service providers (MAXIMA, Sejaya, MIFIDA, Ananya (including Prayas), SATYA (including SATYA Micro Housing), AVIOM, Loan Frame, HUMO, and MyShubhLife) including non-consolidated companies.