Gojo & Company, Inc. (“Gojo”) is pleased to announce its first venture into Georgia with the acquisition of 16.8% stake in JSC Credo Bank (“Credo”), the country’s fifth-largest commercial bank. Credo transformed from a microfinance organization into a full-fledged bank after obtaining a banking license in 2017. Gojo will support Credo to continue pursuing its mission of supporting Georgia’s micro, small and medium entrepreneurs and their employees to create a better future by offering affordable financial services.

Credo offers a comprehensive suite of banking products and services through both traditional and digital channels. As of December 2023, Credo managed a total asset of approximately 2.5 billion Georgian Lari (USD 918 million). By tailoring its offerings to the seasonality of businesses, Credo effectively supports predominantly rural entrepreneurs who often lack access to financial solutions and are underserved by traditional banks. Credo’s business and retail loans, installment loans and deposit products further empower clients to build financial resilience. The convenience of credit and debit cards as well as daily banking ensures Credo’s clients have easy access to funds and seamless transactions.

Zaza Pirtskhelava, Chief Executive Officer at Credo, said, “It is with great pleasure that I welcome Gojo as a new shareholder. Their involvement will significantly strengthen Credo Bank’s positioning and reinforce our goal of providing sustainable financial services to micro, small and medium-sized entrepreneurs with a special focus on digitalization and innovative product delivery. This landmark transaction underscores our shareholders’ trust in the bank and its potential as a solid foundation for our future growth, while advancing financial inclusion, positive environmental and social impact.”

“We are delighted to partner with Credo to advance our shared mission of accelerating financial inclusion worldwide. Credo has been instrumental in expanding access to financial services in rural Georgia, and we look forward to supporting its continued growth and development.” said Taejun Shin, Founder & CEO at Gojo.

PwC Georgia acted as the legal advisor for this transaction.

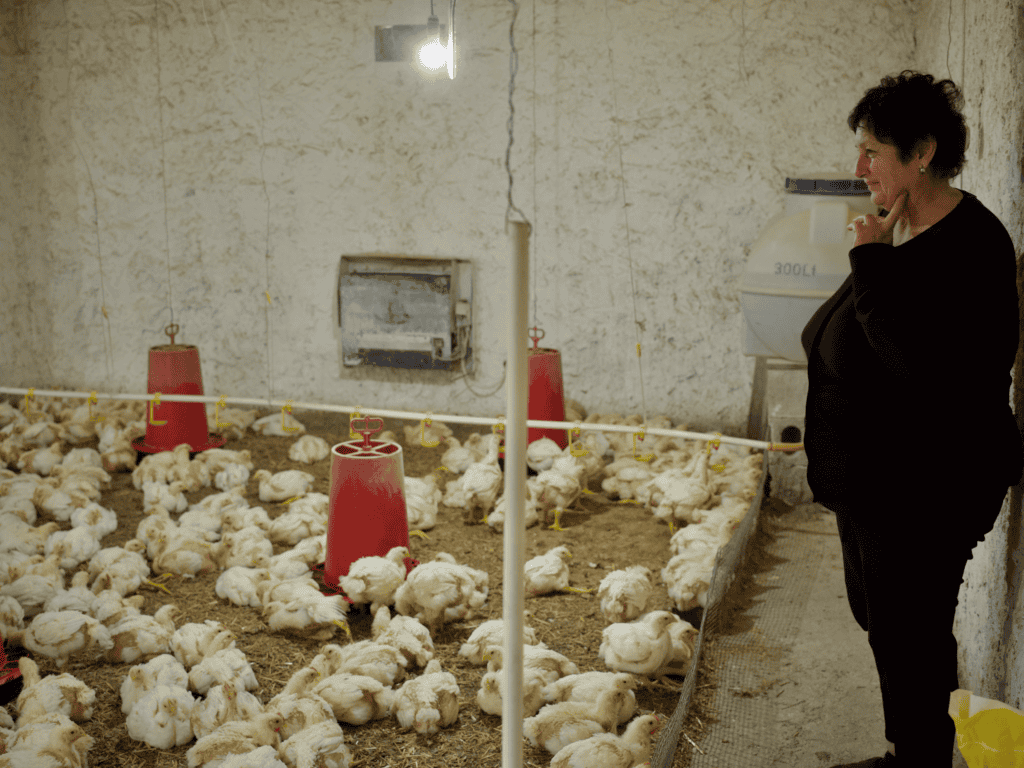

Woman in Georgia who runs a poultry farm with funding from microcredit / Taejun Shin

About JSC Credo Bank

Credo is the fifth-largest commercial bank in Georgia. With its wide regional outreach through 94 service centers, it offers fully-fledged and innovative banking services to over 480,000 customers. The bank’s mission is to support Georgia’s micro, small and medium sized entrepreneurs and their employees to create a better future by offering affordable financial services. It is owned by international social impact and development finance institutions such as Access Credo GmbH from Germany, funds managed by Triodos Investment Management BV from the Netherlands, Development Finance Institution Proparco (Groupe Agence Française de Développement) from France and now Gojo & Company, Inc. from Japan.

About Gojo & Company

Gojo is a Tokyo-based holding company of inclusive financial service providers operating in 13 countries in Southeast Asia, South Asia, Central Asia & the Caucasus, and Africa. Gojo was founded in 2014 to extend financial inclusion across the globe. Gojo Group including major investees is serving more than 2.4 million clients across the globe, through over 10 thousand group employees as of March 2024.