This is the first in a series of blog posts by Sohil Shah, from our investment team, about Gojo's investment thesis and why we chose each of our partner companies.

There are more than 63 million Micro, Small and Medium Enterprises (MSME) in India1. That is a huge number. They contribute to 30% of India’s GDP. That is significant. They employ over 100 million people. That is impactful.

Of the 63 million MSMEs, 99.4% are micro enterprises. These are the ones that you regularly encounter in your daily life. From the ubiquitous kirana (grocery) stores, to hardware stores, stationery shops, recharge and remittance shops, they are all around us.

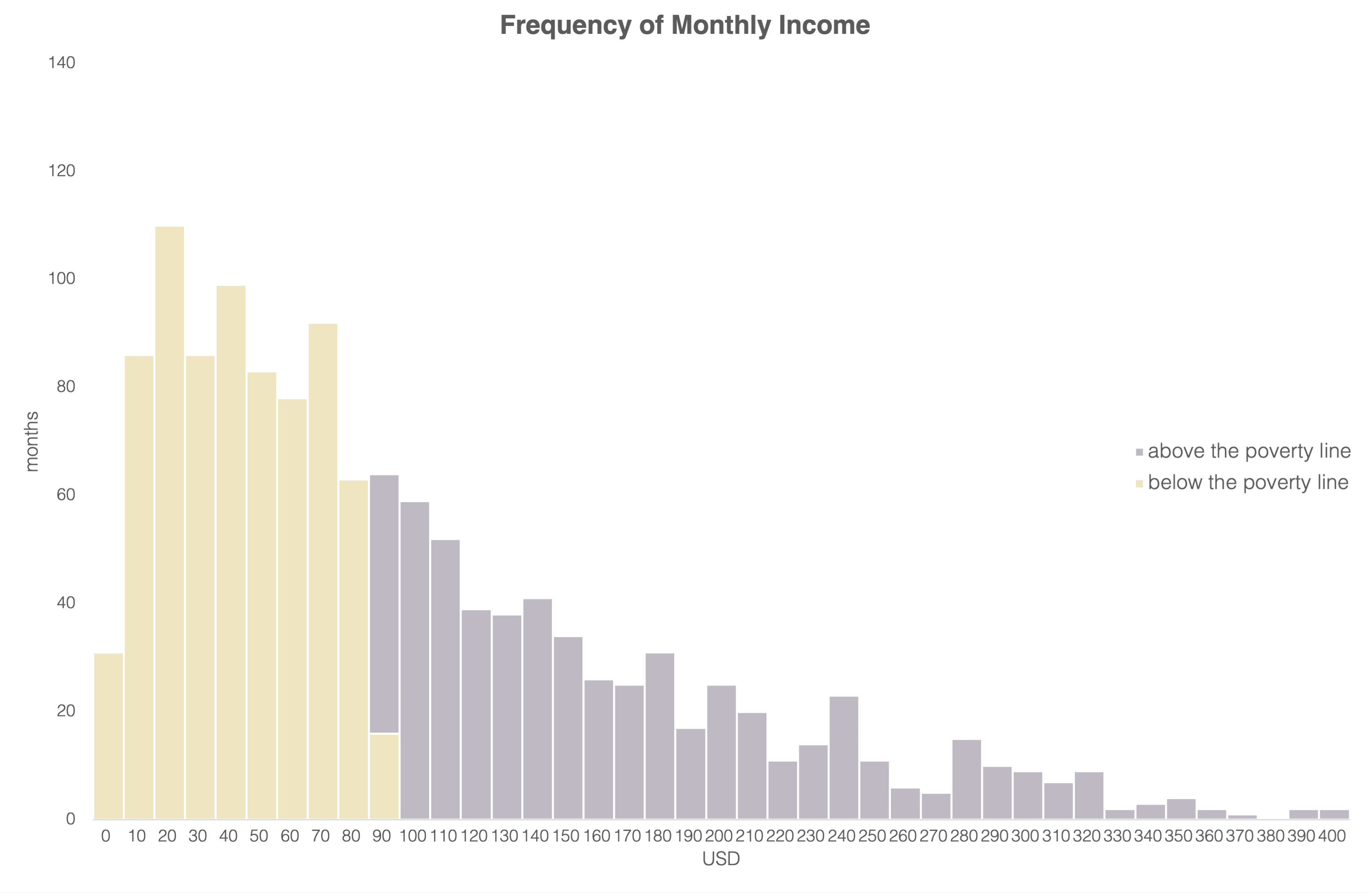

But did you ever wonder why these businesses often struggle and remain small, with a lot of them ultimately shutting down? Certain credible researchers in the country point to “lack of access to finance” as the single largest problem plaguing the MSME industry. It is estimated that the current unmet credit gap is roughly USD 300 billion, and is expected to increase to USD 900 billion by 2022. On further investigation, it wasn’t difficult to see that in reality, a lot of MSMEs remain excluded from the formal financial system. This gave us our next investment objective!

When we started looking at the MSME financing space, one sub-sector that stood out was Supply Chain Finance (SCF). Truth be told, SCF has been around in various forms for a long time. The most traditional forms of SCF have been trade financing and factoring, which are largely dominated by large or international banks on one side and mid-to-large corporates on the other. Moreover, banks have traditionally preferred offering simple working capital loans over supply chain financing due to lack of borrower data and difficulty in assessing the collateral provided. Until very recently, this created a large vacuum in the space.

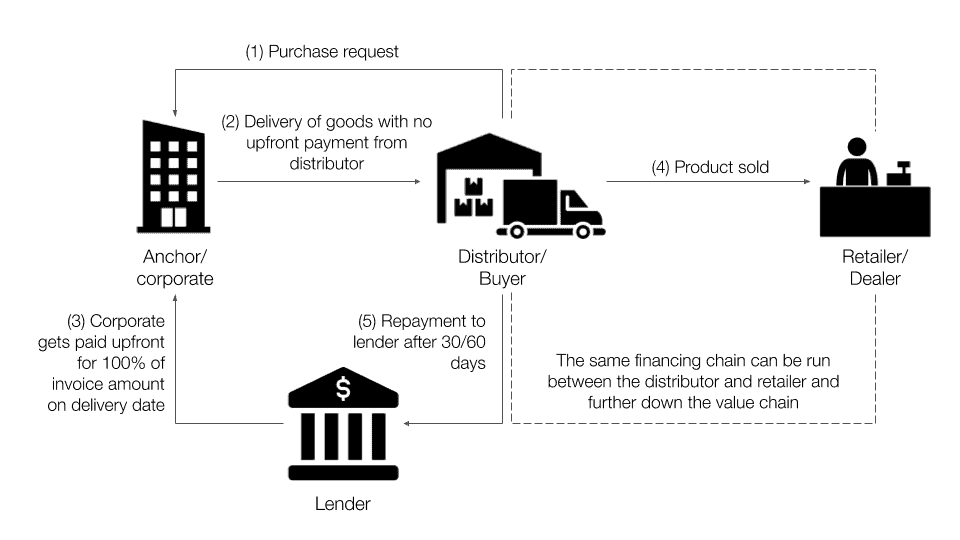

The following diagram illustrates how Supply Chain Finance (SCF) works:

The advent of fintechs has revolutionized the SCF segment. From running analytics on transaction or trade data to providing app- or platform-based financing, technology is set to make the SCF process more efficient, flexible and transparent. With technology, lenders can now provide financing to the MSMEs further down the value chain. SCF can enable MSME suppliers, distributors and retailers to increase their working capital by availing low cost and flexible credit, which in turn opens up new business or expansion opportunities. At the same time, it also helps corporates to improve their working capital management and enables lenders to assess, measure, and manage the risks of extending financing to MSMEs more effectively.

On further investigation, there were some aspects of SCF that we really liked:

- Hugely underpenetrated market: Around 90% of anchor/corporates do not have a supply chain finance program for their distributors / retailers, representing a ~USD 100 billion lending opportunity

- Limited delinquency: The closed-loop financing built on a strong relationship between a corporate and its distributors/retailers helps in keeping delinquencies low

- Limited end-use prevents diversion of funds: The biggest reason for defaults in MSMEs is lack of financial discipline. MSMEs borrow citing business reasons, but may divert funds for personal / lifestyle needs. In SCF, the payment is made directly to the Anchor, restricting the end use to financing MSME working capital, further minimizing defaults

- Repeat business and data: Lending is done on the basis of invoices raised by the anchor/corporate. The inherent nature of this product creates borrower stickiness and allows large-scale collection of data on distributors and retailers which eventually helps in determining market trends and managing sectoral disruptions and risks

Loan Frame Technologies, our most recent investment, is a fintech platform working in this space. We are excited by Loan Frame’s vision of leveraging cutting-edge technologies and data to build the most sophisticated next generation micro-business lending platform in India. The team is passionate about serving under-banked micro-businesses which aligns well with Gojo’s vision of extending financial inclusion across emerging markets.

Loan Frame’s proprietary and flexible technology platform enables short term and flexible credit to distributors, dealers and retailers associated with mid- to large-sized corporates. The company primarily focuses on distribution finance, where it provides 7-90 day pay-as-you-use working capital products. Distribution finance gives small businesses credit primarily for purchasing inventory whilst helping corporates to better manage their receivables.

Unlike a lot of fintechs who jump right into action, the team spent a couple of years understanding the real challenges that micro businesses grapple with and how technology can sustainably solve these issues. The initial phase was exclusively spent on building a top-shelf technology platform – one which integrates directly with the anchor/corporate and communicates with lender and distributor/retailer via web or app on real-time basis.

One key thing the team realized fairly quickly is that SCF cannot succeed with a “one-size-fits-all” approach, and that’s where we believe the Company has built its moat. Loan Frame has a very nuanced approach to underwriting developed through their deep understanding of the segments where they operate. This differentiated approach has allowed the Company to assess businesses in the context of the industry where they operate, thus opening up possibilities for those MSMEs with previously limited access to credit.

Finally, Loan Frame’s composite lending model combines the benefits of both on-balance sheet lending, which provides the ability to test innovative products in new markets or segments, and off-balance sheet lending, which is highly scalable and capital efficient. This gives it an edge in comparison to traditional lenders.

By the time we decided to invest in Loan Frame, it was already on track to achieve approximately USD 100 million in disbursals and we hadn’t even scratched the surface! We believe this is a timely and well-aligned partnership to build India’s largest and most preferred tech-enabled MSME lending platform.

Sohil Shah is a member of Gojo's investment team. He leads the process of building Gojo's investment pipeline and selecting our long-term partners to further our mission of extending financial inclusion to everyone.