As a contribution to the post-COVID recovery, GOJO’s Operations will post a series of posts related to effective delinquency management practices, which could be helpful for the readers. This is the first blog post with more posts to follow.

Microfinance Institutions (MFIs) were long evolving on the correct idea that poor people can pull themselves out of poverty by borrowing small amounts of money. Before the widespread adoption of mobile phones, loan officers delivered these loans directly to small groups of women or individual borrowers. As loan officers were working and living in the neighborhood, they would initiate peer pressure to encourage the repayment of the loan1.

In recent years the digital transformation in the financial sector has taken the delivery of small loans to a very new level. As smartphones have taken over the world and cost per 1GB of data continued to decrease in most places, fully digital microfinance players started to gain market presence and pose competitive pressure on traditional players. Their model does not rely on the judgment of loan officers or group members but the metadata from the borrower’s smartphone. The advanced R&D, IT, and behavior-based scoring have become keys for the success of this newly rising business model in the microfinance sector.

Thus, as these business models would require different drivers for effective operations, the critical business elements of each model also differ:

| TRADITIONAL MICROFINANCE PLAYER | FULLY DIGITAL PLAYER |

|---|---|

| - Branches/Proximity - Loan officers | - Algorithms - Software engineers |

Note that it is generally very difficult to have all parts of this equation in one institution. Traditional MFIs usually don’t have adequate resources for the successful R&D needed to develop practical metadata-based scoring, and most digital MFIs are not interested in the investment in branches and loan officers because they fear it would drive all California-based hi-tech investors out of them. (One of the aims of Gojo Group MFIs in their digital transformation journey is to achieve that difficult balance of “Tech & Touch” that leverages the efficiency of digital processes while keeping the trust-worthiness and inclusivity of in-person interactions, but that’s already the topic of other posts on this blog.)

No matter which of the two approaches you lean towards, in 2020 players of both kinds have faced a very new enemy. This enemy didn’t care much about the scoring model MFIs would use. The hit of COVID-19 had an astonishing effect on both digital and traditional players, bringing the delinquency levels in the microfinance sector to levels no one could imagine possible.

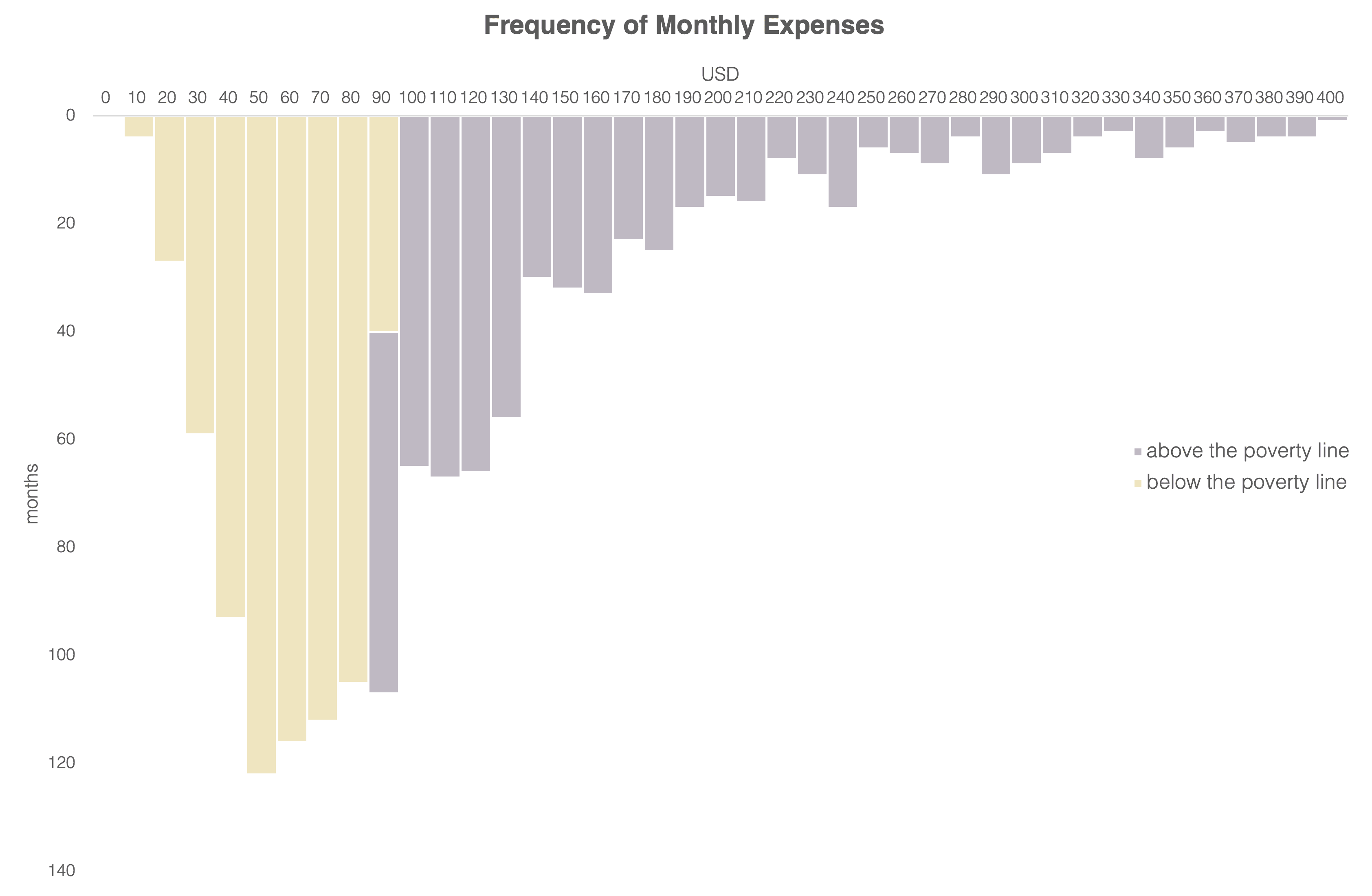

In some countries, the virus outbreak has interflowed with other predicaments changing the situation from bad to worse. In Myanmar, the COVID-19 epidemic, intensified by the civil war after the well-known coup d'état, has affected the PAR>30 levels in the microfinance sector to a staggering 90%. Suddenly, traditional MFIs, which have always enjoyed a PAR>302 at about 1%, were left with staff and systems not trained to manage the avalanche of cases needing restructuring and rescheduling. And the digital MFIs were simply left with nothing but relying on countless SMSs and calls from out-of-country call centers.

But as the dust gradually began to settle, the level of PAR>30 among MFIs of Myanmar began to differ. Data from August 2021 shows that while some institutions were able to reach the relatively suitable level of portfolio quality, a significant number of other MFIs continued to struggle with very high delinquency rates.

As most Myanmar MFIs have relatively similar products, systems, and personnel capacity, the critical differentiator here was the readiness and the efficiency of the deployment of delinquency management systems. MFIs that were more efficient in reaching out to customers with new, tailor-made offers to deal with sudden repayment difficulties ended up in a much better state and continue to widen their advantage.

The situation in Myanmar substantiated that no matter what type of MFI you are running, traditional or digital, the new reality will force you to consider the investment in developing a new element in your business model:

| TRADITIONAL MICROFINANCE PLAYER | FULLY DIGITAL PLAYER |

|---|---|

| - Branches/proximity - Loan officers - Delinquency management system | - Scoring algorithms - Software engineers - Delinquency management system |

Of course, the overall impact of COVID-19 on the microfinance industry has yet to be fully understood. Still, effective delinquency management systems will become essential parts of the competitive advantage of modern MFIs. The MFIs that will deliver the best-in-class efficiency in delinquency management will come out as winners in major contemporary existential crises in the microfinance industry caused by COVID-19. In the following posts, we will discuss the instruments and approaches that proved effective in addressing this task.

1. Gojo and its Partners specifically focus on eliminating pressure practices.

2. Portfolio At Risk (PAR) is the percentage of gross loan portfolio that is at risk. So, PAR 30 is the percentage of the gross loan portfolio for all open loans that is overdue by more than 30 days.

Elchin Abdullayev is part of Gojo's Operations Team, and focuses on financial product development and strategic operation initiatives with Gojo's partners.