By Daria Chelyukanova

Gojo & Company conducted a pilot study of impact accounting for its largest microfinance group company, SATYA MicroCapital Ltd (hereinafter referred to as “SATYA”), with a focus on calculating the net positive and negative impact of the organization on their clients who are typically underserved populations. The study was produced through a research collaboration with the International Foundation for Valuing Impacts (hereinafter referred to as “IFVI”), a non-profit research organization that develops methodologies for impact measurement. The analysis was performed with reference to the impact accounting methodology developed by the Impact-Weighted Accounts project at Harvard Business School, for which development and intellectual property rights have been transferred to IFVI.

An impact accounting approach supplements financial performance assessment and allows Gojo’s stakeholders to gain a comprehensive understanding of the company's financial and social performance. Microfinance institutions (MFIs) play a crucial role in providing financial services to populations that have been excluded from high-quality financial systems, particularly women in developing countries. Therefore, this lack of access to financial services has hindered their economic empowerment. The financial benefits of MFIs for women include increased income and savings, financial literacy, and improved financial management, all of which contribute to improved quality of life. This report aims to quantify the impact of MFIs on income increase within underserved categories, drawing on data collected by SATYA.

Impact-Weighted Accounts Methodology and Gojo’s Approach

The Impact-Weighted Accounts methodology provides a baseline system for impact accounting by providing principles and methods for measuring positive and negative impacts. Impact accounting has emerged as a powerful tool for analyzing the social performance of businesses and contextualizing that performance with financial accounting. By assigning monetary values to impacts, impact accounting provides a comprehensive understanding of a business's overall value creation and sustainability context. This, in turn, can enable more informed decision-making by business owners, clients, and stakeholders. Impact accounting frameworks can be applied to a range of areas, including the environment, employee wellbeing, and economic inclusion.

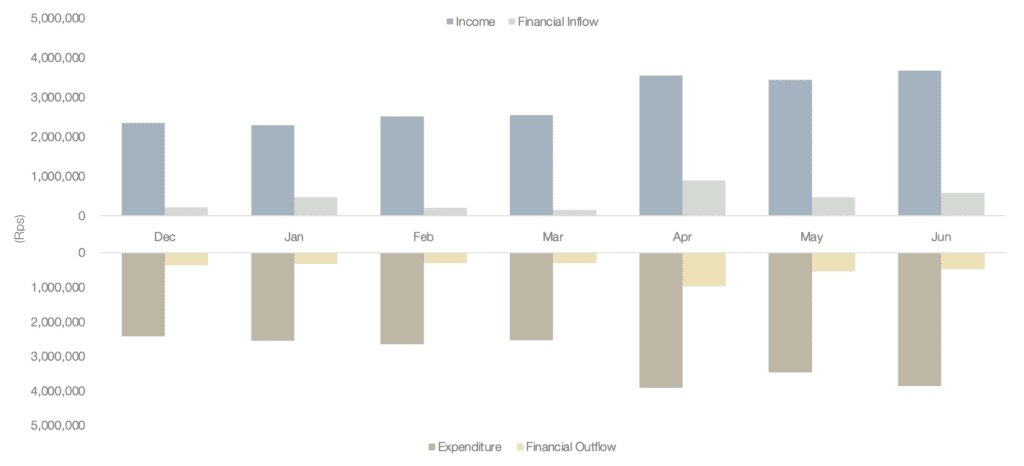

The research collaboration focused on measuring the impact of SATYA’s principal product, microfinance loans to underserved women. Together with IFVI, Gojo identified a number of potential impacts using the Impact-Weighted Accounts framework for categorizing the impact dimensions of products (Chart 1). For example, as Gojo aims to provide affordable services to underserved populations, impacts such as lower pricing of services compared to the industry average and improved access to financial services for female borrowers in rural areas were considered in the Access dimension. In addition to positive impacts, negative impacts were considered. In the Quality dimension, the potential risk of putting clients into over-indebted situations was considered as a negative impact in light of the health and safety of clients.

Chart 1: Impact-Weighted Accounts Impact Dimensions of Products

To demonstrate proof-of-concept in the pilot, the analysis focused on the Access dimension for the underserved. This is an area of particular importance, as many individuals and communities in Gojo’s operating areas face significant barriers to accessing essential goods and services. Amongst the many potential impacts to be measured within the Access dimension, the team agreed to focus on one impact which is income generation of the underserved population. Gojo recognizes that the income of low-income households is not simple to measure, and that it is also naive to assume that income is a good indicator to represent the well-being of households (read more in our Impact Report (2023 July)). Having said that, the team believes that income generation is a good place to start and balances measurement feasibility with the goal of producing insightful information.

Gojo approached the task of measuring the impact of MFIs on the underserved population by conducting a thorough literature review of academic research papers. This enabled the identification of the key indicators and metrics that would be most useful in measuring the impact.

According to our analysis, the impact represents a significant impact, equivalent to 19.45% over SATYA's revenue, demonstrating the ability of MFIs to generate positive outcomes in the lives of their clients.

Challenges and Shortcomings

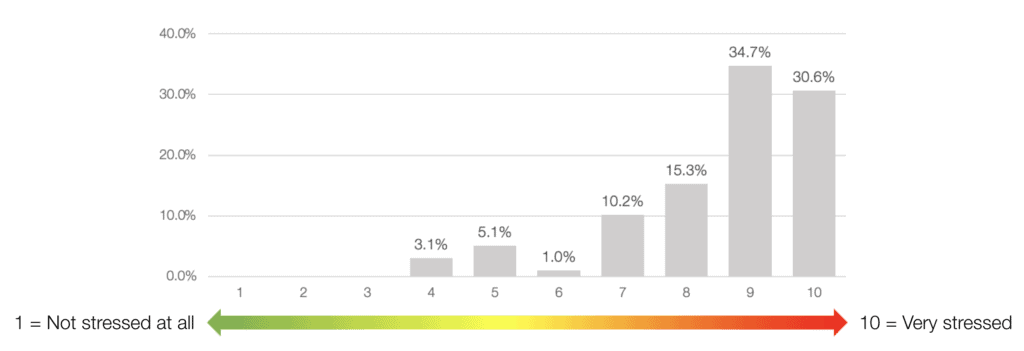

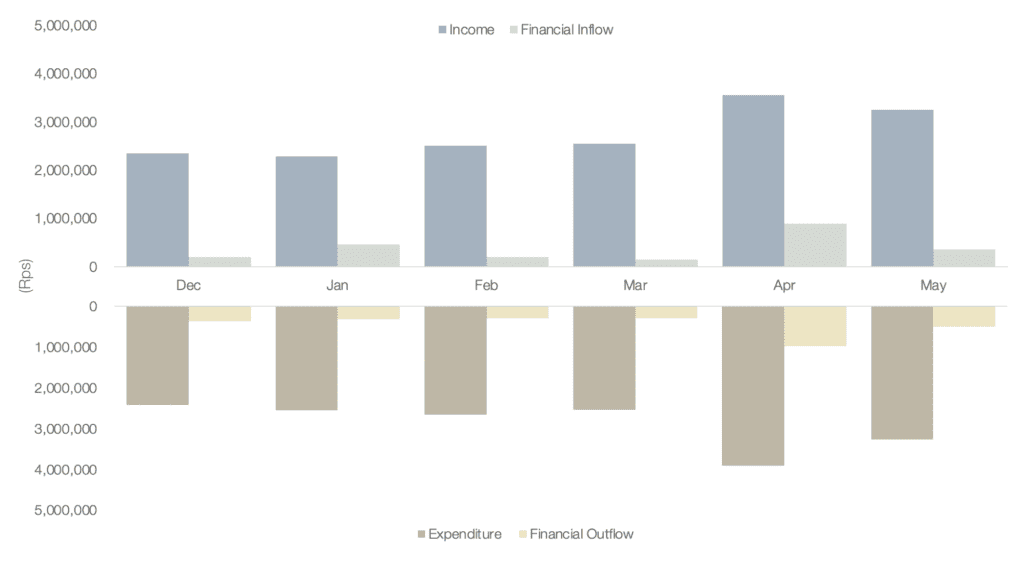

There are several challenges and shortcomings to this pilot project. To begin with, measurement uncertainty is high. Given that the majority of the clients reside in rural areas and their income is informal, and their income fluctuates significantly on a monthly basis, the household income data are subject to a degree of measurement error. In addition to the shortcomings in the survey data, the classification of clients by year and the timing effects of income increases are based on illustrative assumptions.

In the process of developing a pilot report, there was a consideration to include inflation as a variable in the calculation logic. However, it was ultimately decided not to include inflation. When answering the question, survey respondents might have had in mind the real monetary value of any income increase, in which case the 11% represents an improvement in purchasing power, requiring no inflation adjustment. Alternatively, the survey respondents might have been considering the nominal increase in income. We believed it is more likely that respondents answered based on their “feeling” as a proxy for an increase in wellbeing, or purchasing power, and therefore did not include an adjustment.

It is also important to understand that, typically, household income generation comes with business expense increases. Ideally, we should only measure the “net income” of the household, after deducting the business expenses. However, this was not possible due to data availability and represents an area for refinement in any future deployment of impact accounting methods.

Next Steps

As described in the preceding section, there are many challenges that need to be overcome. There are three areas to highlight: 1) reduce the measurement uncertainty of the data, 2) expand the scope to other group companies, and 3) expand the scope to include additional positive and negative impacts. Data accuracy-related issues are already highlighted, and it is necessary to come up with ways to improve this, potentially through further analysis of Management Information System (MIS) data or the collection of more information in the next round of the Impact Assessment Survey. The team notes, however, that information with a high degree of measurement uncertainty may still be highly relevant for business decision-making and lead to outcomes that otherwise would have been overlooked in the absence of that information. In other words, measurement uncertainty by itself does not limit the value of impact accounting information.

In this pilot, the focus was on SATYA as it is the largest group company of Gojo that has rich sources of data. However, Gojo should ideally extend this exercise to other group companies in order to be able to disclose the group-wide impact accounting results. Finally, Gojo focused only on income generation for the pilot, but there are many potential impacts that can be measured and integrated into the impact accounting results, including negative ones. Gojo should find ways to measure different types of impact and understand how they relate to one another, and eventually reflect it in the overall impact accounts.