Why governance matters for Gojo is clear — Because Gojo aims to operate in 50 countries by 2030, which means Gojo will have to manage at least 50 different group companies as a holding company by then.

This is a message from Kohei Katada, Gojo's CFO and devoted teamplayer.

Me and teamwork

Working together as a team and winning a game has always been an important part of my life.

Since I started working, it has become difficult for me to make time for team sports, so I mainly enjoy individual sports (triathlons, marathons, and recently, kickboxing). However, teamwork has always been an important part of my life as I have played various team sports such as soccer, basketball, and lacrosse since my childhood.

Recently, Taejun, our founder, recommended that I watch “The Playbook”, a documentary series on various sports coaches on Netflix. In this blog, I would like to write about my thoughts on teamwork at work.

What is teamwork

When I think back to some of the most memorable projects I’ve had, they have always involved teamwork with wonderfully talented people. When I was in investment banking, M&A advisory work required collaboration with clients, supervisors, colleagues, and external stakeholders such as lawyers and tax accountants. Preparing for the IPO of LIFENET INSURANCE also required close cooperation with the management team, a securities firm, and leaders from different departments. At Gojo, we have overcome many challenges as a team, such as raising funds for the Series D round and implementation of IFRS across group companies.

What is teamwork in the first place? I personally found the following definition by Andrew Carnegie, the Steel Magnate, to be the most convincing (I was a little happy to learn that the term “teamwork” existed over 100 years ago, even in Carnegie’s time!):

“Teamwork is the ability to work together toward a common vision. The ability to direct individual accomplishments toward organizational objectives. It is the fuel that allows common people to attain uncommon results.”

Mr. Deguchi, the founder of LIFENET INSURANCE, where I used to serve as CFO, had this to say about people and teamwork:

“People are all different and imperfect. By combining uneven members with different strengths, you can build a team like a strong stone wall and achieve great results.”

There is also a famous African proverb that goes like this:

“If you want to go fast, go alone. If you want to go far, go together.”

Essentials of teamwork

So, what do we need to work effectively as a team in a diverse, low-context environment like Gojo?

My hypothesis, which is still under development, is that the following elements are necessary.

Three prerequisites:

(from “Team Geek” by Brian W. Fitzpatrick, Ben Collins-Sussman)

- Humility: No one on the team is perfect, and no one knows the right answer alone.

- Respect: A sincere concern for the people you work with. Treating members as individuals and fairly evaluating their abilities and achievements.

- Trust: Belief that every other team member is capable and will do the right thing.

Team Geek also has the following statement, which I agree with 100%.

“Almost every social conflict can ultimately be traced back to a lack of humility, respect or trust.”

Three key elements:

- Shared Purpose/Goals: Each team member must share the purpose and goals with strong ownership.

- Communication: Sharing information is the basis for good decision-making. High-frequency communication is essential for mutual trust and psychological safety.

- Feedback: Based on the belief that everyone can grow, support each other’s growth and development through mutual feedback.

Our team

When I joined Gojo in 2019, I wrote the following in my personal blog.

“I’m committed to devoting myself to everything I must/want to do to bring Gojo closer to its vision. However, it would be impossible for me to do this on my own, so I want to gather the best people I can find and steadily build up step by step to move forward.”

Two and a half years have passed since I joined Gojo. The road has not been smooth, with the Covid-19 pandemic and the coup d'état in Myanmar…etc., however, my desire to build the best team in the industry with the best people has not changed from day 1.

In order to share our purpose as a team, we discussed and created our team’s mission statement during a workshop in 2020 and have been brushing it up every now and then. Below is the latest version of the statement.

- Enhance the credibility of Gojo and its Partners (group companies) as an investment destination through transparent communication and amplify the financial inclusion around the world

- Enable internal stakeholders within Gojo and Partners to make high-quality decisions and to achieve our mission, by delivering reliable financial information and thoughtful risk/opportunity analyses in a timely manner

- Explore and implement an optimal and resilient capital structure that supports dynamic resource allocation in collaboration with Partners

Inch by inch

I’d like to conclude this post by writing about “winning” as a team.

I mentioned the documentary “The Playbook — A Coach’s Rules For Life” at the beginning of this post. It was indeed great and I would recommend it to everyone, especially if you have ever played a team sport.

Personally, I’d recommend Episode 1: Doc Rivers, who is currently the head coach of the Philadelphia 76ers (The documentary is mostly about his days with the Boston Celtics and Los Angeles Clippers). I was particularly impressed by the following two statements by him.

“A person is a person through other people. I can’t be all I can be unless you are all you can be. (…) I can never be threatened by you because you’re good, because the better you are, the better I am.”

(Rule No. 3: UBUNTU IS A WAY OF LIFE)“Champions get hit over, and over, and over. You know, it’s just that the champion is the one that decides to keep moving forward”

(Rule No. 5: CHAMPIONS KEEP MOVING FORWARD)

The second quote is about the 2008 NBA Finals, in which the Boston Celtics defied all expectations to win against the L.A. Lakers and become NBA champions for the first time in 24 years.

One last thing. Let me quote here my favorite speech Al Pacino from the movie “Any Given Sunday”.

“You find out that life is just a game of inches. So is football. Because in either game — life or football — the margin for error is so small. I mean one half step too late or too early and you don’t quite make it. One-half second too slow or too fast and you don’t quite catch it. The inches we need are everywhere around us. They are in every break of the game every minute, every second.

On this team, we fight for that inch. On this team, we tear ourselves and everyone else around us to pieces for that inch. We claw with our fingernails for that inch. Because we know when we add up all those inches that’s gonna make the f****** difference between WINNING and LOSING, between LIVING and DYING!”

Our long-term goal is to enable the provision of high-quality affordable financial services for 100+ million unserved and underserved people in 50+ countries by 2030. There have been and I believe there will be so many unexpected things happening. However, let’s work together as a team and move forward one step at a time, inch by inch, until we win.

Kohei Katada is Gojo’s CFO. He leads Gojo’s fundraising, finance and admin teams. Prior to joining Gojo, Kohei served as the Senior Vice President of Finance at SmartNews and as CFO at LIFENET INSURANCE COMPANY.

As a contribution to the post-COVID recovery, GOJO’s Operations will post a series of posts related to effective delinquency management practices, which could be helpful for the readers. This is the first blog post with more posts to follow.

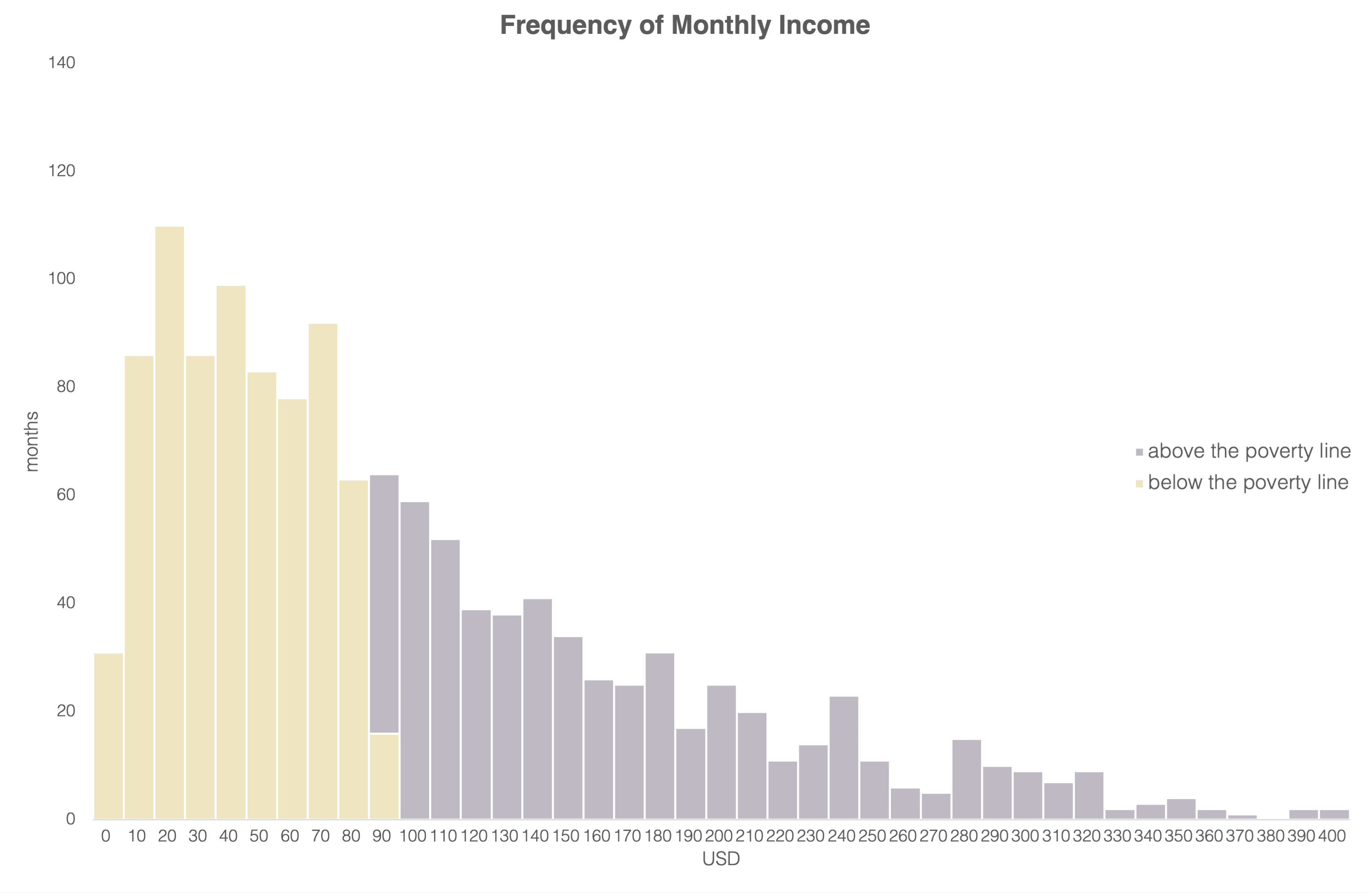

Microfinance Institutions (MFIs) were long evolving on the correct idea that poor people can pull themselves out of poverty by borrowing small amounts of money. Before the widespread adoption of mobile phones, loan officers delivered these loans directly to small groups of women or individual borrowers. As loan officers were working and living in the neighborhood, they would initiate peer pressure to encourage the repayment of the loan1.

In recent years the digital transformation in the financial sector has taken the delivery of small loans to a very new level. As smartphones have taken over the world and cost per 1GB of data continued to decrease in most places, fully digital microfinance players started to gain market presence and pose competitive pressure on traditional players. Their model does not rely on the judgment of loan officers or group members but the metadata from the borrower’s smartphone. The advanced R&D, IT, and behavior-based scoring have become keys for the success of this newly rising business model in the microfinance sector.

Thus, as these business models would require different drivers for effective operations, the critical business elements of each model also differ:

| TRADITIONAL MICROFINANCE PLAYER | FULLY DIGITAL PLAYER |

|---|---|

| - Branches/Proximity - Loan officers | - Algorithms - Software engineers |

Note that it is generally very difficult to have all parts of this equation in one institution. Traditional MFIs usually don’t have adequate resources for the successful R&D needed to develop practical metadata-based scoring, and most digital MFIs are not interested in the investment in branches and loan officers because they fear it would drive all California-based hi-tech investors out of them. (One of the aims of Gojo Group MFIs in their digital transformation journey is to achieve that difficult balance of “Tech & Touch” that leverages the efficiency of digital processes while keeping the trust-worthiness and inclusivity of in-person interactions, but that’s already the topic of other posts on this blog.)

No matter which of the two approaches you lean towards, in 2020 players of both kinds have faced a very new enemy. This enemy didn’t care much about the scoring model MFIs would use. The hit of COVID-19 had an astonishing effect on both digital and traditional players, bringing the delinquency levels in the microfinance sector to levels no one could imagine possible.

In some countries, the virus outbreak has interflowed with other predicaments changing the situation from bad to worse. In Myanmar, the COVID-19 epidemic, intensified by the civil war after the well-known coup d'état, has affected the PAR>30 levels in the microfinance sector to a staggering 90%. Suddenly, traditional MFIs, which have always enjoyed a PAR>302 at about 1%, were left with staff and systems not trained to manage the avalanche of cases needing restructuring and rescheduling. And the digital MFIs were simply left with nothing but relying on countless SMSs and calls from out-of-country call centers.

But as the dust gradually began to settle, the level of PAR>30 among MFIs of Myanmar began to differ. Data from August 2021 shows that while some institutions were able to reach the relatively suitable level of portfolio quality, a significant number of other MFIs continued to struggle with very high delinquency rates.

As most Myanmar MFIs have relatively similar products, systems, and personnel capacity, the critical differentiator here was the readiness and the efficiency of the deployment of delinquency management systems. MFIs that were more efficient in reaching out to customers with new, tailor-made offers to deal with sudden repayment difficulties ended up in a much better state and continue to widen their advantage.

The situation in Myanmar substantiated that no matter what type of MFI you are running, traditional or digital, the new reality will force you to consider the investment in developing a new element in your business model:

| TRADITIONAL MICROFINANCE PLAYER | FULLY DIGITAL PLAYER |

|---|---|

| - Branches/proximity - Loan officers - Delinquency management system | - Scoring algorithms - Software engineers - Delinquency management system |

Of course, the overall impact of COVID-19 on the microfinance industry has yet to be fully understood. Still, effective delinquency management systems will become essential parts of the competitive advantage of modern MFIs. The MFIs that will deliver the best-in-class efficiency in delinquency management will come out as winners in major contemporary existential crises in the microfinance industry caused by COVID-19. In the following posts, we will discuss the instruments and approaches that proved effective in addressing this task.

1. Gojo and its Partners specifically focus on eliminating pressure practices.

2. Portfolio At Risk (PAR) is the percentage of gross loan portfolio that is at risk. So, PAR 30 is the percentage of the gross loan portfolio for all open loans that is overdue by more than 30 days.

Elchin Abdullayev is part of Gojo's Operations Team, and focuses on financial product development and strategic operation initiatives with Gojo's partners.

On 20th January 2022, we held a webinar to share how Humo, our newest partner company, has established Humo Lab to spearhead digitalization and innovation. At Humo Lab, several products have been developed and launched, including mobile banking apps, payment apps, kiosks, and more. The webinar focused on Humo’s introduction, sharing best practices on how microfinance institutions can do better to extend financial inclusion.

The one-hour event featured Taejun Shin (Founder & CEO, Gojo & Company), Firdavs Mayunusov (Co-founder and General Director, MDO Humo), Firdavs Nuriddinzoda (Director of HumoLab, MDO Humo), moderated by Arnaud Ventura (Managing Partner, Gojo & Company). The webinar consisted of four parts: Introduction of Gojo & Company, Introduction of Humo, Introduction of Humo Lab, and Panel Discussion.

In the first part, Taejun shared what financial inclusion is, what Gojo strives to achieve and how Gojo operates in many parts of the world with its newest footprint being Tajikistan. It was followed by a talk from Firdavs M. covering the history and evolution of Humo, the story of how Humo Lab was established, and how the collaboration between tech and business teams allows disruptive thinking. Firdavs N. continued the presentation to introduce user-friendly services of Humo Lab and strategies behind their provision. The last 20 minutes was a panel discussion answering questions from audience, including topics such as synergies between Gojo and Humo.

The webinar was a great success, attended by over 150 people from 22 countries. The webinar was followed by an Ask Me Anything session where the audiences enjoyed direct interaction with the panelists.

To watch or rewatch the webinar, the recording is available here:

https://www.youtube.com/watch?v=qOG8y8JIIH0

If you are interested in learning more about Gojo and receiving invitations to our future webinars, subscribe to our newsletter at the bottom of this page.

Gojo recently developed its leave policy by which everyone is entitled to 14 weeks maternity and paternity, 100% paid by the company up to a certain amount. According to our study, it is the most generous of this kind. I became the second person inside the organization to use it, and I was away from the office from late September until late October (I wish I could make it longer!). I am not alone — during the pandemic period, Gojo members are seeing a baby boom, and some more will take it soon.

Let me write about why we developed this policy and the things I hadn't realized before taking the leave.

A good parental leave policy is essential for pursuing gender parity in society. The gender pay gap is insignificant when both men and women don't have kids. The gap conspicuously widens after they become parents. In many countries, only women take maternity leave and look after the newborn babies, and their role tends to remain fixed even after the end of the maternity leave. Thus the gender gap widens. To prevent this from happening, both men and women should take ma/paternity leave.

Not only that. A strong leave policy makes the organization more sustainable. Che Guevara used to say something like, "no one is irreplaceable." Organizations should be able to run just as well even when key people are absent, including the founder CEO.

However, after taking my paternity leave, I learned a few more things.

First, I learned that it is an extreme joy to spend time with a newborn baby. Her face changes literally every day (I took a photo every single day, so I am sure). I learn something new about her every day, and vice versa. I felt that every input I gave to her impacted her development. It is a fantastic experience that all parents ought to enjoy.

Second, it makes a happy family. Especially under covid, even husbands are not allowed to spend the first several days with the neonatal baby. These days generate a significant “parental IQ” gap between women and men. If men don't take paternity leave, it is almost impossible to catch up. The result would be that wives always look after all kids-related matters, and husbands cannot be involved (some are deliberately not involved). The grudge gets larger every month. In the worst-case scenario, husbands become isolated from their family members. Some Japanese men told me things like, "after I became a father, my wife started focusing on kids only, and I felt like I became an ATM." In Japan, many old-age divorces are due to kids-related matters. It is a sad thing — they loved each other to the point of getting married, and the result of the marriage becomes the cause of divorce.

If you take paternity leave and actively join kids-raising, you will not experience this problem. At the very least, my relationship with my wife got even better after having a baby.

Third, after skipping the company's Executive Committee for 5 consecutive times, I confirmed that even without me, the organization would get going. I read the meeting minutes and watched the meeting videos, realizing that all the key problems are raised and analyzed well, and all the required solutions are executed.

The experience made me think about what is my raison d'etre. As the founder CEO, I am here to bring about non-linear change to the organization, delivering something the other colleagues cannot do. Following my period of leave, my work time allocation changed considerably, and I see some positive results already.

We are always looking for talent. If you are interested, please visit our website! https://gojo.co/join-us

Taejun is the co-founder and CEO of Gojo. He is passionate about equality of opportunity. Prior to founding Gojo, Taejun worked in investment banking and founded Living in Peace, an NGO.

In this post Haruna, a member of Gojo's Corporate Planning Team, shares her career journey until she joined Gojo, and what she learned in the process. Enjoy!

What does “work” mean to you? It means a lot to me — as someone once said, more than half of your time awake is time spent at work, so it should bring joy. I fully agree with this statement. In my view, it should not just bring joy, but also be meaningful. Today I will share my journey on how I built up my career, what my struggles and lessons learned were, and how I eventually decided to shift my career to pursue my original hope of serving the developing countries. I hope it will be interesting to those who are thinking about shifting their career, especially in a more “social” direction.

When I graduated from university, I questioned myself, “what do I want to spend my time on?” I wanted to make sure I spent time on something I thought was important, and to me, at that time, working to improve the life of poor people in developing countries felt much more impactful than spending time to bring marginal value to already somewhat-fulfilled people in Japan. So I started looking for a government job to support developing countries. However, I could not get an offer and, when I got my first offer from a consulting company, I stopped searching. At that time, I wanted to focus on my university orchestra activities and wasn’t thinking very seriously about my career and future, so I ended up starting my career as a strategy consultant.

The experience was terrible. Very long working hours, no proper training, a bad relationship with the manager all piled up to become a lot of stress. I started getting both mental and physical issues, and had to take leave of absence. I went back to work after 3 months, but was asked to leave the company at the end of my third year.

I quickly searched for a new job. Luckily, because of my “strategy consultant” background, I got a lot of offers. I chose to go to a company called Rakuten, a Japan-based e-commerce company, which was trying to go global at that time — including developing countries in Asia and Africa. I thought that maybe this job could connect one day to my original wish of serving the developing countries.

This job change turned out to be a success. I worked closely with the CEO and had a chance to see the company from his view, which was a whole new experience for me — it definitely pushed me up to a different level. I started to enjoy work for the first time in my life, and started to feel that I was making a difference. I increased my presence within the company and was soon promoted to become one of the youngest business heads. I had a lot of struggles there too, but really enjoyed growing the business supported by a great team. Moreover, I loved the people at Rakuten. Everywhere, there was the culture of moving fast, getting things done.

However, even though my career at Rakuten was successful, I started to question myself again, the same question I asked myself when I had first started my career: “what did I really want to spend my time on?” I hadn’t forgotten my initial aspiration of contributing to the people in developing countries. I tried to chase this dream within Rakuten by raising my hand to meet startups in India, visiting Africa to find business opportunities etc. I also started looking outside to find things to do outside work to fulfill my wish — I joined a network of professionals supporting social startups, and I started to volunteer for an NGO supporting children in Africa. I even started a similar kind of program within Rakuten, an accelerator to support social startups by Rakuten employees.

I could have continued like this, but once I experienced the deep sense of achievement and fulfillment by putting my energy into something to which I was really committed, it was hard for me to fully focus on my assigned job at Rakuten. I decided to shift my career to pursue my original mission — to support developing countries and reduce poverty. It was a tough decision. I had to leave behind 10 years worth of social credit I had built, a good salary, a stable job which I knew how to run, a managerial position — basically a successful career. People said I should continue at Rakuten, especially as I had just given birth to my second child, and I was already going through a lot of changes in life. I could understand this argument, but one day I asked myself: if I died today, would I have any regrets or not? The answer was clear: I would regret not having spent my work time on something I thought was meaningful.

So here I am at Gojo & Company, a startup with a mission to extend financial inclusion to everyone, so that people can determine their own future. The mission resonates with my personal values, and so far my 6 months at Gojo have been great. Of course, there are pros and cons, and there never is a “perfect job”. My salary went down significantly, and I need to work more. Lots of new things to learn, a new culture to get used to, new people to get to know — all of this requires hard work. Having said that, the best thing here is that there are like-minded people around me who take social impact seriously. There are so many things which I can tackle that seem interesting and important — the kind of things I really pushed for at Rakuten but never got management attention can easily become an important project here at Gojo. Although it might be too early to tell, I think I managed to make a successful transition.

Aligning your personal mission with the company’s mission may not matter so much if you think about your day to day work. Having a good relationship with your colleagues, working on a fun yet challenging job, and having good work-life balance matters more in the short run. But if you stop and look back on what you have achieved, and see that it is exactly the impact you wanted to make on the world, there is a deep sense of satisfaction. So, I want to encourage those who are hesitating — “it is never too late to pursue your mission!”

Haruna Tanaka works for the Corporate Planning Department at Gojo & Company. She works on various projects at Gojo, including corporate governance, social performance management, stakeholder impact management, client impact measurement and R&D.

As I was getting involved in microfinance in the late 90s, it was mainly operated by 2 types of players: Non-Profit Organisations (such as NGOs and International NGOs) and Cooperatives. Most countries had not yet set up regulations to allow commercial microfinance banks to operate.

I remember the significant opposition against commercial microfinance by many players in the microfinance sector. Many donor representatives but also a large number of practitioners did not feel comfortable with the commercial model. The cooperative movement was perceived by many as the “ideal” model, allowing the end beneficiaries to be part of the governance of the microfinance banks to decide on their services. Cooperative systems were perceived as superior models.

Beyond the governance, it is also clear that private ownership in microfinance was not accepted for another reason. The idea that private interest could generate profits from “poor people” was unacceptable to most.

As I co-founded PlaNet Finance in 1998 with the support of Jacques Attali and Muhammed Yunus (Chairman of the Advisory Board) and started providing independent rating & evaluations in the sector, as well as other services (consulting and funding), we started evaluating and financing many MFIs.

As we were doing so, in the early 2000s, we witnessed many cooperatives failing. In West Africa but also in Latin America and other parts of the world, large cooperatives were bankrupt or nearly bankrupt, only being saved by governments and development agencies providing them every year with the funds they needed to survive. At this time, I got involved with PlaNet Finance & PlaNet Rating in many programmes with cooperatives, either to try to support / save some of those cooperative microfinance banks by providing them with technical assistance (such as in Mexico for instance) or to rate and evaluate them and allow governments or donors to design programmes to support them (such as in West Africa)

For years (mainly in the late 80s and 90s), a number of international cooperative movements such as Desjardins International, Crédit Mutuel International, WOCCU, were promoting the models that had worked in their home countries internationally by supporting local microfinance cooperatives with expertise and funding..

However, during the 2000s decade, commercial microfinance emerged and started growing at an accelerated pace, to become during the 2010s the main player in the microfinance sector.

How come commercial microfinance was able in less than 10 years to thrive while cooperatives did not manage in the previous 30 years?

There are probably many reasons behind this factor but I would like to highlight 2 of the reasons which I believe are fundamentally behind the success1 of commercial and the failure of cooperatives models in microfinance:

- The efficiency of commercial microfinance. This efficiency is largely the result of efficient decision making which private companies with simple and aligned shareholding bases and clear decision makers excel at doing. Cooperative microfinance banks are often struggling with complex governance, many hundreds of owners (the clients) with different and sometimes conflicting agenda which makes decision making much more complicated and sometimes impossible. In specific situations, a strong leader is able to make this governance structure work and can, thanks to his/her natural authority and/or his legitimacy, accelerate decision making. This was for instance the case at Grameen Bank, a cooperative bank with a strong charismatic leader, the founder: Muhammed Yunus. However, unfortunately too few cooperative microfinance banks could benefit from such a charismatic leader.

- The strength of commercial capital: as was expected in the early 2000s, as soon as commercial investors realized that microfinance was a new asset class they could benefit from, with potentially good profitability, commercial capital started to flow significantly into the sector. And commercial capital was invested primarily into commercial microfinance rather than cooperatives, not only because of the reason above but also because of legal & regulatory limitations (much easier to invest in a private company than in a cooperative company). As a reminder, in 2020 more than 150 million people have access to microfinance with a total loan portfolio above 140 billion USD, while in the early 2000s, microfinance was reaching fewer than 20 million people for a portfolio below 20 billion USD. Commercial capital is largely responsible for this huge growth in the last 20 years.

I think this story around Efficiency, commercial and cooperative decision making can be applied beyond the cooperative sector (for instance the public sector or government-owned businesses, etc.). I would argue that the key to efficiency is alignment. An organization is efficient if the key stakeholders are fully aligned so that decisions can be made quickly and implemented efficiently. There are many ways to reach alignment in an organisation but the most efficient ways are probably those highlighted above:

- One, or a limited number, of charismatic leaders followed by their teams,

- A simple governance with very few owners aligned on the same goals.

As many microfinance banks are now facing serious challenges to face digital disruption and to meet clients’ expectations, quick decision making and alignment are going to be key success factors in upcoming digital transformation, so it is time for every organisation to learn from history and improve their governance & organisation to become more efficient in decision making.

Arnaud Ventura is a Managing Partner of Gojo & Company. As Managing Partner, Arnaud oversees strategy, business performance & development. He also leads the development of Gojo & Company in Africa.

Prior to joining Gojo, Arnaud founded and led two of the leading financial inclusion group worldwide. From 1998 to 2008 Arnaud cofounded and led with Mr Attali & Mr Yunus PlaNet Finance, one of the global and most successful European Financial Inclusion Group. From 2008 to 2019, Arnaud founded & led Baobab (formerly MicroCred), the leading Micro&SME digital bank in Africa & China.Additionally, Arnaud has been appointed Young Global Leader of the World Economic Forum in 2013 and he cofounded the French China Foundation the leading network of Young Leaders between French and China and Share Africa, a platform to support African youth.

In order to speed up loan approval processes, many banks and microfinance institutions use computer algorithms to calculate credit scores. I'm sure many of you are familiar with seeing a numerical credit score like '700'.

Credit scoring collects various pieces of information about a loan applicant and maps them to a single number. Based on the applicant’s loan repayment history, their use of other financial services, and other factors, the algorithm calculates a score such as '670 for this applicant', '740 for that applicant', and so on. And if the score is lower than the predefined threshold, the loan will not be approved.

Here, I would like to introduce a little theorem that makes up a part of Gojo's credit scoring approach.

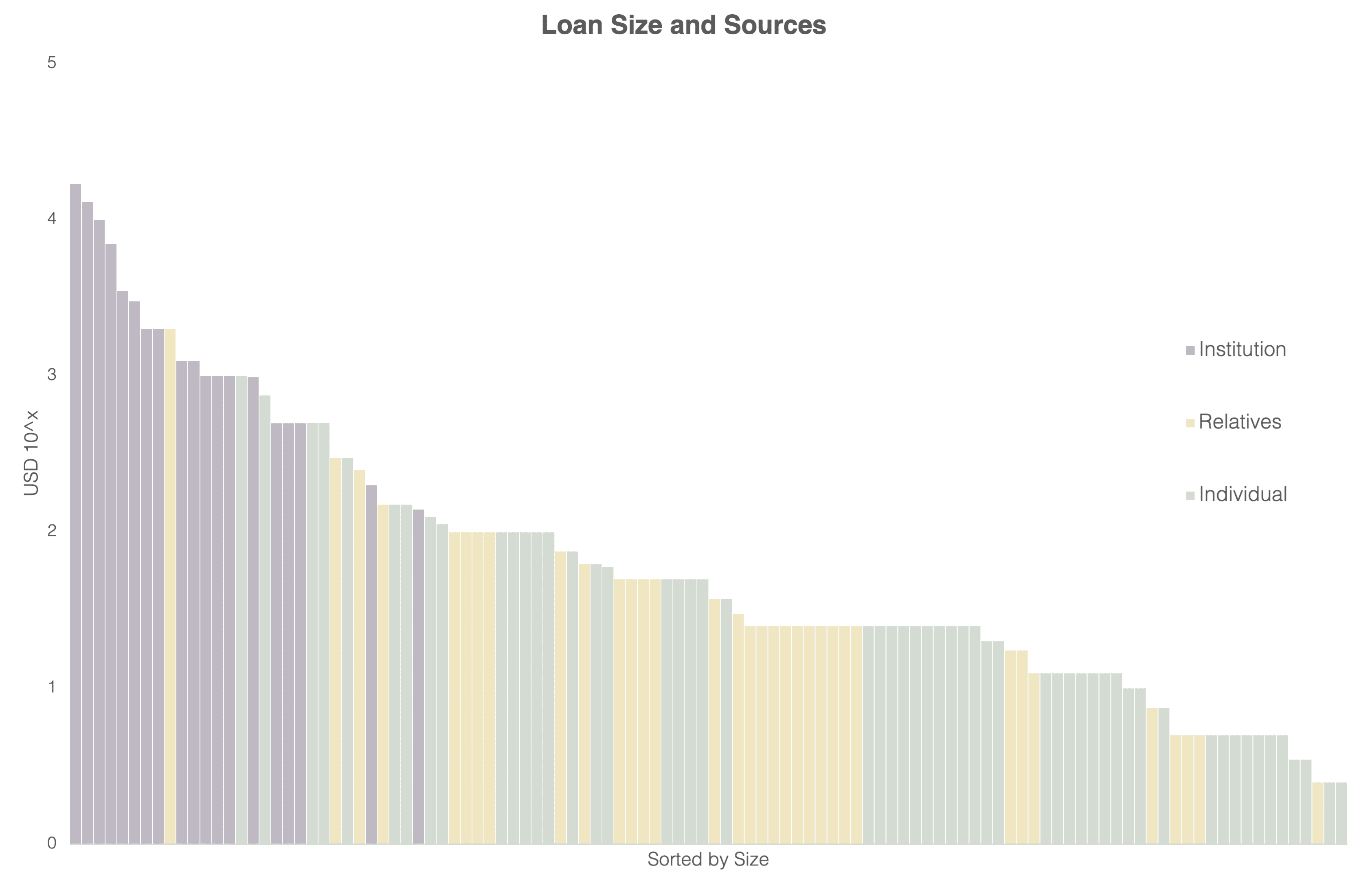

Whether or not you can repay a loan without issues depends to a large extent on the size of the loan. For example, if I take a loan of $1 million, and spend it all at once without thinking, I will probably have a problem repaying it later. However, if I take a loan of $1, and use it to pay for some expenses, I will probably not have a problem repaying it later. In other words, credit scoring, which measures my ability to repay the loan, should be a function of the loan size.

Now, let's extend this view just a little bit more. The larger the loan size, the higher the credit score that should be required for the borrower, and therefore the higher the hurdle. The smaller the loan size, the lower the credit score that should be required for the borrower, and the lower the hurdle.

If that is the case, then for any given borrower, there should be a loan size that represents a manageable hurdle. For any kind of borrower, if we keep reducing the loan size, we will eventually find an amount that matches the maximum credit score they can achieve.

The above paragraphs outline a little theorem about credit scoring, which is my favorite. Of course, we can take a further step to consider how we might apply it in practice.

Why don't we just look for the (maximum) loan size we believe a borrower can handle, and use that as their credit score? Rather than producing a score like '670' or '740', it would be easier for everyone to understand that $500 is the maximum possible amount they would be allowed to borrow. If the amount is clear, borrowers can plan their investment.

We are actually applying this approach in a loan product currently being offered by Maxima, our partner in Cambodia. Their small digital loans project (also known as MBela) uses an automated assessment process to provide a credit score in the form of the maximum amount each person can borrow. The resulting credit score is easy for both the agent and borrower to understand.

Gojo wants to provide services that are innovative in their simplicity.

Yoshinari Noguchi is a researcher at Gojo and Company. He works in Gojo’s R&D team, and is currently looking into new ways to understand and support money management for low-income people, as well as analysis of data from the Hrishipara diaries and Gojo’s own financial diary projects.

In this blog post we introduce The Fit Factor: Matching Loans and Savings to Cash Flows, a new paper from Gojo’s R&D team.

Typically, when we set out to measure the impact of a loan on someone’s life, we tend to look at what happens after they take the loan— for instance, whether their income increases, whether they are able to spend more on education, or whether they acquire more assets. However, there are a couple of limitations to this approach:

- Outcomes data taken following a loan tends to be a snapshot of a certain point in time, and is usually collected at a time pre-determined by the service provider, rather than at a time that makes sense for the borrower in terms of when they expect to see results from the loan

- Changes in income and increased spending on education can be influenced by many different factors in a person’s life, not just their access to finance. For instance, we see in financial diary research that unexpected events happen more often than we might think, such as accidents, sudden medical needs, new opportunities, and other events which may disrupt the original plans a borrower had for their loan

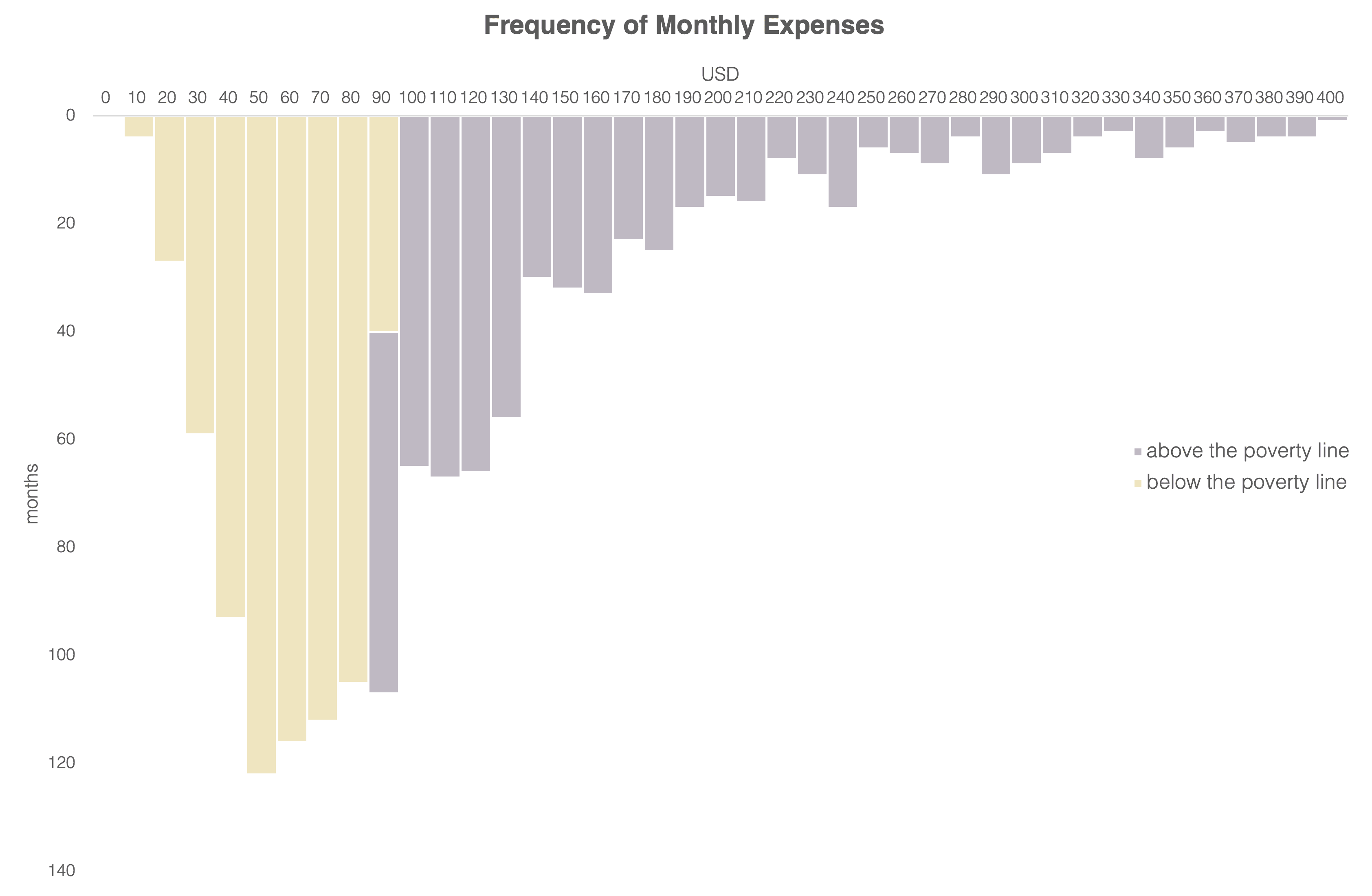

While outcomes data is useful, it cannot give us the full picture of the utility provided by a loan or other financial service. What if, in addition to outcomes data, we considered the impact of a financial service from a cash flow perspective? In other words, what if we could see how loans or savings fit with clients’ real cash flows and affect their day-to-day money management?

Using data from Stuart Rutherford’s Hrishipara Daily Diaries project, we would like to introduce a new impact measure which looks at how financial services either reduce or add to the volatility of a person’s cash flows. Our working assumption is that services which increase cash flow volatility generally make money harder to manage, and vice versa. We call this measure of impact on volatility the Fit Factor.

Read our paper setting out the concept, its applications as an impact measure, and its limitations here.

Yoshinari Noguchi is a researcher at Gojo and Company. He works in Gojo’s R&D team, and is currently looking into new ways to understand and support money management for low-income people, as well as analysis of data from the Hrishipara diaries and Gojo’s own financial diary projects.

Cheriel Neo leads impact measurement at Gojo and is also a member of Gojo’s R&D team. She is setting up and running Gojo’s financial diary projects in Cambodia and Sri Lanka, and is interested in using data to better understand Gojo’s current and target clients.

In today's digital world, physical cash is rapidly becoming a relic of traditional financial systems that have disadvantaged the unbanked. By combining mobile digital financial tools (such as mobile remittances and loan disbursal) with other money management tools (such as financial education), we believe unbanked people can access financial services and break out of the poverty cycle. At Gojo, we wish to include financially excluded people and enable them to achieve financial goals and self-sufficiency.

I joined Gojo as a Software Engineer in August 2020 to enable this mission and solve our mobile engineering challenges, of which there are many. I’m going to talk about two of these today.

Challenge #1:

How do you create a Digital Field Application system that works even if the cell tower is down?

Most of the time, we take internet access for granted. That’s not the case for our customers in many countries, where the internet can be patchy and a precious resource. In order to ensure that our DFA didn’t stop working when the internet did, we had to architect our technology to be offline-first.

First, we loaded our app onto an Android tablet with 32GB of storage. We were able to store all the relevant data like names, photos, and loans locally on each device. The user, typically someone like a loan agent, doesn’t even need to know whether the tablet is online or offline, because the app behaves the same either way.

In the event of the internet dropping off, as soon as the tablet is reconnected to the internet, the data automatically syncs with our servers. That enables us to maintain data quality despite patchy internet.

Challenge #2:

How do you enable field agents to update their Customer Forms on the fly to capture desired and customisable client data?

A critical piece of our Digital Field Application is to collect client information on tablets. This information is then used to make a decision on whether a client is eligible for a loan or not. These forms can vary widely depending on the data capture requirements of the partner. Keeping the fact in mind that the KYC forms could change on a regular basis, it did not make sense for us to go for a conventional route, i.e., to hardcode forms on the tablet itself.

We solved this problem by implementing the SDUI (Server Driven User Interface) architecture for our form screens. It works in conjunction with the offline architecture I mentioned above to render the latest version of the form to the client when the internet connectivity is present, or the latest cached version in the offline scenario.

It provided us the following benefits:

- Partners no longer need to depend on mobile developers to update the app to show specific changes in forms or to change the order of the UI. An agent can now use a web portal to make any changes he/she wants in the forms and it would be reflected in the app instantly.

- It’s easier for loan agents to introduce new form fields, like images and map views from their office computers and have it reflect on the mobile app.

- It enables the engineering team to create more reusable form components and scale across partners, because we do not have to hardcode the forms for each of our partners.

As we continue to scale our Digital Field Application across Gojo partner companies, these solutions will evolve, but we're confident that our approach of immersive design and innovative development is the best way to yield technology that is as resilient and adaptive as the people in the places where it is meant to be used.

Jeet Dholakia works as part of Gojo's technology team as a software engineer, focusing particularly on mobile engineering. He is passionate about solving complex engineering problems and good mobile design, and is currently working on Gojo's Digital Field Application and Customer Mobile Application.

Sign up to receive news from Gojo here.