Gojo & Company, Inc. (“Gojo”) is pleased to announce the acquisition of 9.0% stake in CJSC Bank Arvand (“Arvand”), a commercial bank in Tajikistan in November 2024. This is Gojo's second investment in the country following the investment in CJSC MDO “HUMO” in 2021. Arvand is the fourth largest financial institution including banks and micro credit deposit organizations in Tajikistan, having obtained its banking license in 2019. Gojo will progressively work towards strong collaboration and support Arvand in its mission to provide appropriate and high-quality financial services to entrepreneurs and individuals, with the aim of stimulating the economic and social growth of Tajikistan.

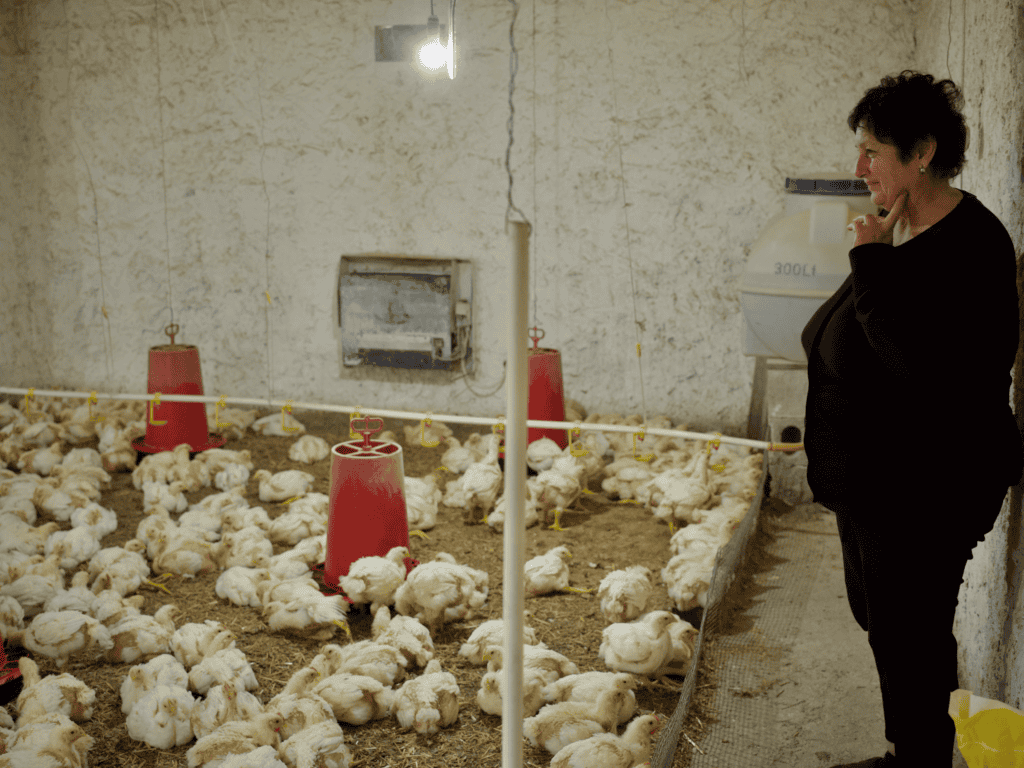

Arvand offers unsecured loans which enable low-income households and micro-entrepreneurs to increase their income and improve their living standards, achieving a Gross Loan Portfolio of USD 115 million as of December 2024. In addition to loans, Arvand provides a wide range of financial services, including deposit accounts, remittances, online banking, currency exchange, ATM cards, and cash management solutions. Arvand’s strategic focus on digitalisation has successfully driven significant progress, with more than 65% of client transactions now being conducted through digital channels. Beyond financial services, Arvand supports its clients with non-financial offerings such as training programs and consultations on financial literacy.

Ms. Shoira Sodiqova, Chief Executive Officer at Arvand, said “The investment from a globally recognised and highly reputable international investor like Gojo is a testament to the trust we have earned and the results of our ongoing efforts to deliver high-quality, essential financial services to the unbanked. We aim to expand opportunities for clients by enhancing both the scale and quality of our services, solidifying our position as a leader in sustainable finance. With Gojo, it will be possible.”

“Arvand is one of the most trusted and respected banks serving the micro and SME clients of Tajikistan, and we are very pleased to partner with them. This is Gojo’s second investment in Tajikistan which underscores our confidence in the depth of the market and the robust regulatory regime. We remain optimistic about the country’s future and look forward to supporting the growth and development of Bank Arvand.” said Sohil Shah, Principal and Head of VC at Gojo.

Gojo acquired Arvand shares from Triodos Microfinance Fund and Triodos Fair Share Fund (managed by Triodos Investment Management), Rural Impulse Fund II (managed by Incofin Investment Management), and from Arvand (treasury stock).

About CJSC Bank Arvand

Arvand is a leading financial institution in Tajikistan’s microfinance sector, dedicated to empowering low-income families, micro-entrepreneurs, and small businesses to improve their livelihoods and contribute to the country’s economic growth. With a network of approximately 70 service points and a team of 900 skilled professionals nationwide as of December 2024, Arvand delivers innovative and inclusive financial services to over 317,000 clients, including 54,000 borrowers. As a market pioneer in implementing an ESG (Environmental, Social, and Governance) strategy, Arvand has made significant strides in promoting sustainable finance. Notably, 10% of its loan portfolio is dedicated to Green Finance initiatives. The bank also demonstrates a strong commitment to social inclusion, with 42% of its borrowers being women, over 70% residing in rural areas, and 33% classified as low-income individuals. Additionally, approximately 30% of Arvand’s offices are strategically located in remote regions of Tajikistan, ensuring access to financial services for underserved communities.

About Gojo & Company

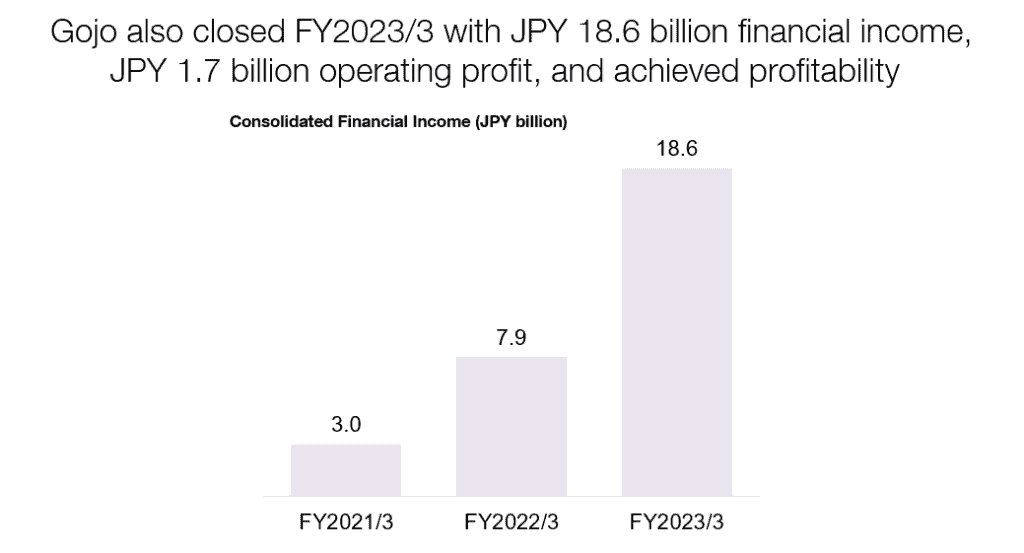

Gojo is a Tokyo-based holding company of inclusive financial service providers operating in 13 countries in Southeast Asia, South Asia, Central Asia & the Caucasus, and Africa. Gojo was founded in 2014 to extend financial inclusion across the globe. Gojo Group including major investees is serving more than 2.4 million clients across the globe, through over 10 thousand group employees as of March 2024. Gojo is a Certified B Corporation™, committed to the continuous improvement of its social and environmental performance.